Stock Deep Dive: Could This Small-Cap Be the Next Big Beauty Stock?

This small-cap beauty stock is quietly building a next-gen empire

In an industry dominated by giants like Estee Lauder and L'Oreal, one small-cap disruptor is making waves with a radically different approach to beauty. Meet Oddity, a digital-first, AI-powered beauty company that is blending technology, data science, and direct-to-consumer strategy to reshape how products are developed, marketed, and sold.

With brands like Il Makiage and SpoiledChild, Oddity is not just selling cosmetics and skincare. It is also building a vertically integrated, software-driven engine designed to identify consumer needs faster and deliver personalized products at scale. Since its IPO in 2023, the company has drawn attention from both growth investors and beauty insiders, not just for its sleek branding, but for its robust unit economics and aggressive reinvestment strategy.

But is Oddity just another trendy upstart riding a short-term wave, or is it laying the foundation for a long-term beauty empire? In this deep dive, I will break down Oddity’s business model, financial profile, market positioning, and the key risks and catalysts that could determine whether this stock has real staying power.

Business overview

The company owns 2 major brands:

Il Makiage. A data-driven cosmetics brand focused on complexion and color products. It is known for its AI-powered shade matching and personalized onboarding funnel

SpoiledChild. It is a newer entry into the personal care and wellness space, offering customizable products targeting longevity, hair health, and skincare concerns. It follows the same tech-first model with adaptive algorithms guiding product recommendations

This slide, from the investor presentation deck, illustrates how Oddity’s technology platform serves as the backbone of its business today, while also pointing to its broader strategic potential. Currently, the platform powers the onboarding, growth, and retention of customers across Oddity’s core brands by combining advanced capabilities in data science, machine learning, digital marketing, and UX optimization.

Each layer of the platform plays a role:

A massive data lake feeds insights across brands and functions

Technology tools like hyperspectral vision, molecular discovery, and video-on-demand content create hyper-personalized consumer experiences

The platform enables fast product iteration and targeted marketing across verticals, giving Oddity a measurable edge in customer acquisition and lifetime value

While today it supports internal brands, the architecture is built for scalability and monetization beyond DTC beauty. The slide hints at three future growth vectors:

New Brand Launches. The platform can onboard and scale additional in-house or acquired brands (Brand 3, Brand 4)

Partner Brands. Oddity could license its platform and infrastructure to external partners, transforming into a tech enabler

Data Monetization. With a rich data ecosystem, Oddity can commercialize its insights across beauty, wellness, and even adjacent sectors

In short, Oddity is not just building brands, it is laying the groundwork for a platform business with multiple monetization layers. As I explained in my article on the company, L’Oreal is attempting a similar transformation. However, given its size and deep-rooted legacy, it cannot pivot as quickly and is unlikely to reach the level of technological integration that defines born-digital brands like Oddity.

Business model breakdown

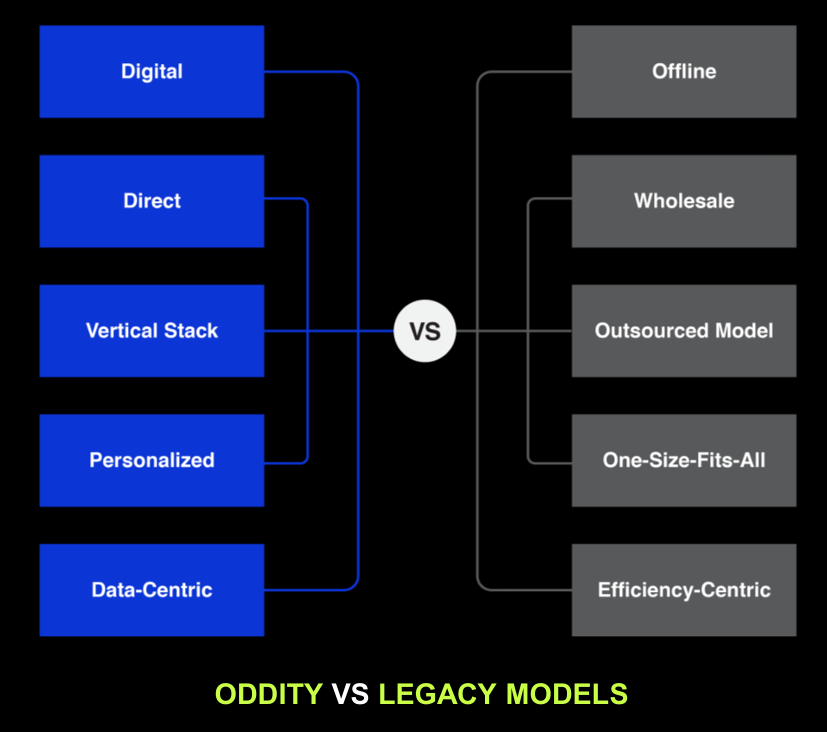

Oddity operates more like a tech company in the beauty industry, leveraging a proprietary digital platform to build, scale, and optimize its brands. Its direct-to-consumer model is powered by data, machine learning, and full control of the customer journey; giving it a structural advantage over traditional beauty incumbents.

Here are the key pillars of the business model:

Tech-driven DTC model. 100% of sales occur through Oddity’s own digital channels, allowing for higher margins, faster feedback loops, and full ownership of customer data

Proprietary platform infrastructure. The in-house tech stack includes data science, AI, hyperspectral imaging, and molecular discovery tools, all built on a unified data lake

Scalable brand engine. The platform supports the launch and growth of multiple brands like Il Makiage and SpoiledChild, with plans for more

Future monetization potential. The same technology powering its own brands could be licensed to partners, sold as SaaS, or monetized through data, offering upside beyond product sales

The platform is optimized to grow revenue across both customer acquisition and retention. The chart highlights a compelling trend: customers continue to repurchase and their average spend rises year after year.

A simple yet powerful example of the business model’s strength is how Oddity used its rich data ecosystem to reduce return rates on its best-selling shades by 15%. By analyzing a wide range of inputs (purchases, returns, reviews, repurchases, and even customer images) the company was able to fine-tune its product recommendations and significantly improve the customer experience.

In the following sections, you will find detailed insights into key metrics, fair price estimation, a comprehensive SWOT analysis (strengths, weaknesses, opportunities, and risks), and precise buy zone identification. Subscribe now to unlock full access to this newsletter, including exclusive analyses, portfolio tracking, screeners and curated stock picks

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.