Smartcraft: the Potential Behind this SaaS Company

Why is Smartcraft poised for long-term success?

Among the Software as a Service (SaaS) companies, Smartcraft stands out as a promising player with significant growth potential. The alignment of market conditions, management strategies, and execution creates significant potential for shareholders. But what exactly is driving this company's success, and how does its future look? In this deep dive, we will explore the key factors behind Smartcraft’s potential, its strategic positioning, and the opportunities it can leverage for sustained growth.

Company overview

Smartcraft is a SaaS platform designed specifically for small and medium-sized enterprises (SMEs) in the construction industry. It provides a comprehensive suite of software solutions that streamline business operations for construction companies. With 12,500 customers and 120,000 users primarily located in the Nordic region (Norway, Sweden, and Finland) and the UK, Smartcraft has established a strong presence. Notably, recurring revenue accounts for over 95% of its total revenue.

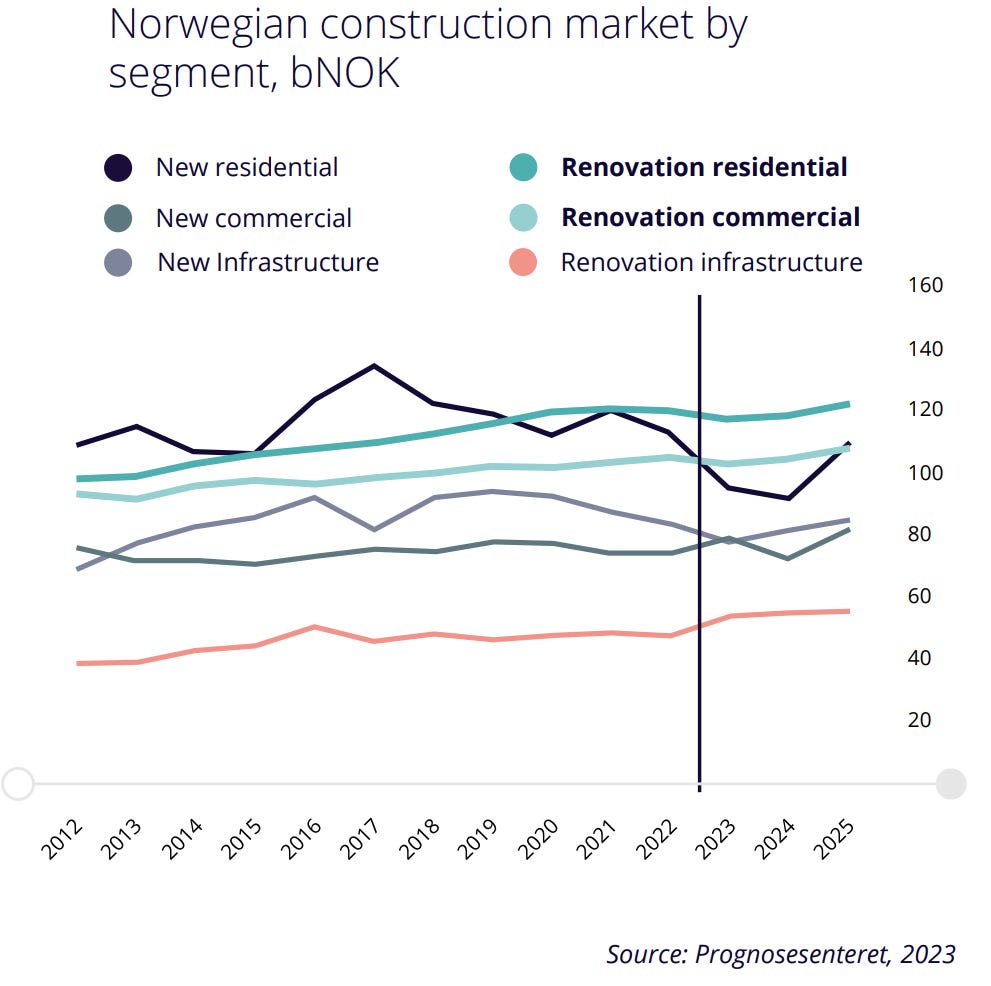

Primarily utilized in the renovation segment of the construction industry, Smartcraft enables companies to efficiently manage their documentation, workforce, and materials, addressing three of the main challenges faced in this industry.

This chart highlights one of Smartcraft's key strengths. The company operates in a traditionally under-digitalized sector, providing ample room for growth. Furthermore, it is positioned within a less volatile segment of the construction industry. Renovation projects are less susceptible to economic fluctuations and demographic shifts, and the renovation market is significantly larger than the new construction market.

There is also a consistent demand for renovation, maintenance, and services for existing buildings. A strong tailwind exists in the growing need for improved energy efficiency in buildings, which drives the necessity for renovations.

However, the industry faces several challenges. For instance, the average profit margins for Smartcraft's customers typically range between 0% and 5%, leading to a high rate of bankruptcies. This, in turn, contributes to a churn rate of around 8% for Smartcraft, which is relatively manageable.

A modular software suite

Smartcraft provides a wide range of modules tailored for each phase of the property life cycle. Many of these offerings have been integrated through mergers and acquisitions (M&A) in the past, creating substantial value for both customers and the company (we will delve into the M&A aspect later in this article).

What is particularly interesting is that customers can choose the depth of features they need for each module. For instance, they can start with a basic package that enables essential functions like quoting, time and materials management, and order management. As their requirements grow, they can upgrade to more specialized features, such as advanced electrical functionalities or comprehensive project and inventory management, which can cost two to three times the initial price. Additionally, customers can add options for advanced calculations tailored to specific needs for instance.

Smartcraft also addresses specific regulatory requirements. For example, in Sweden, companies must report transportation emissions for each project, a process that can be complex, time-consuming, and documentation-heavy, particularly in the event of an audit. Smartcraft’s Tellus module simplifies this by enabling users to track emissions, which not only helps meet regulatory obligations but also encourages customers to explore additional modules for future upselling.

This forms a best-in-class suite, built on five key pillars:

Project Management. Comprehensive solutions, from basic to advanced project oversight, tailored specifically for electricians and fieldwork management.

Cable Dimensioning. Precise tools for calculating optimal cable dimensions for various installations.

Calculation Tools. Essential for installation planning, project cost estimation, and quoting accuracy.

Quality and Safety. Centralized features for technical inspections, ensuring both quality control and safety compliance.

Communication and Sales. Streamlined processes for property renovations, new developments, after-sales services, and dedicated aftercare teams.

M&A strategy

The company's M&A strategy is notably aggressive, leveraging acquisitions to expand functional coverage, enter new markets, add customers, increase total addressable market (TAM), and enable cross-selling opportunities.

This approach is particularly compelling as the company rapidly generates value through its acquisitions.

Two recent examples highlight this strategy: Clixifix and Locka. Locka, based in Sweden, specializes in 3D visualization and customer interaction solutions for construction companies and property developers. Clixifix, a UK-based company, provides tools for managing complaints, repairs, and defects.

The combined impact of these acquisitions includes an additional 55 million NOK to the company’s annual recurring revenue (ARR), the addition of 600 new customers (with cross-selling opportunities to further enhance value), 55 employees, and significant TAM expansion, especially through Clixifix, where the company previously had no presence.

A huge TAM

The company estimates its current Total Addressable Market (TAM) at approximately 50 billion NOK. Geographically, about two-thirds of this TAM is in the UK, with the remaining one-third split across Norway, Finland, and Sweden, with Sweden being slightly larger.

With current revenues around 400 million NOK, market penetration remains below 1%, including nearly 0% in the UK and 2-3% in the Nordics.

Growth targets

The growth targets will be discussed in this section, followed by a comprehensive review of key metrics, a SWOT analysis to identify risks and opportunities, a fair price estimation, and the projected Total Shareholder Return (TSR).

Subscribe to gain full access to this section and unlock additional content, including in-depth stock analysis, screeners, industry reports, and portfolio insights.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.