Senzime, a Potential 10-Bagger?

Revealing the potential of this fast-growing medical device stock

I enjoy exploring a diverse range of companies in-depth, from large-cap market leaders to small-cap innovators, both in the U.S. and internationally. In this instance, I am looking at Senzime, an early-stage investment that comes with risks that could be as significant as the potential rewards.

Senzime specializes in precision-based patient monitoring solutions, aiming to drive a global shift in perioperative patient safety. With a projected revenue CAGR of around 100% from 2023 to 2026, it stands out as one of the fastest-growing companies in the stock market.

Let’s delve into its business model and, more importantly, assess the company's potential over the next decade. We will also examine the associated risks to provide a comprehensive overview.

Company overview

Senzime's mission is to create “a world free of postoperative complications”. This vision is compelling, as it underscores the company's focus on a critical and growing market. To achieve this, they are developing innovative, algorithm-powered monitoring solutions. Currently, they offer two primary products.

The TetraGraph system is used during surgery to accurately monitor a patient’s level of neuromuscular blockade. It helps to secure the right dose of neuromuscular blocking drugs and their antagonists and it indicates when it is safe for the patients to breathe on their own.

ExSpiron is the first and only non-invasive system for continuous monitoring of minute ventilation (the amount of air breathed in a minute) for early detection of respiratory changes typically after surgery.

What is particularly interesting is that Senzime's business model centers on establishing an installed base of devices, which in turn generates recurring revenue from the ongoing use of its disposable sensors.

The core strength of Senzime's business model lies in its recurring revenue stream. In Q2 2024, devices made up 44% of total revenue, while disposable sensors contributed 56%. By 2030, disposables are expected to account for over 90% of revenue, making this a highly recurring and “sticky” business.

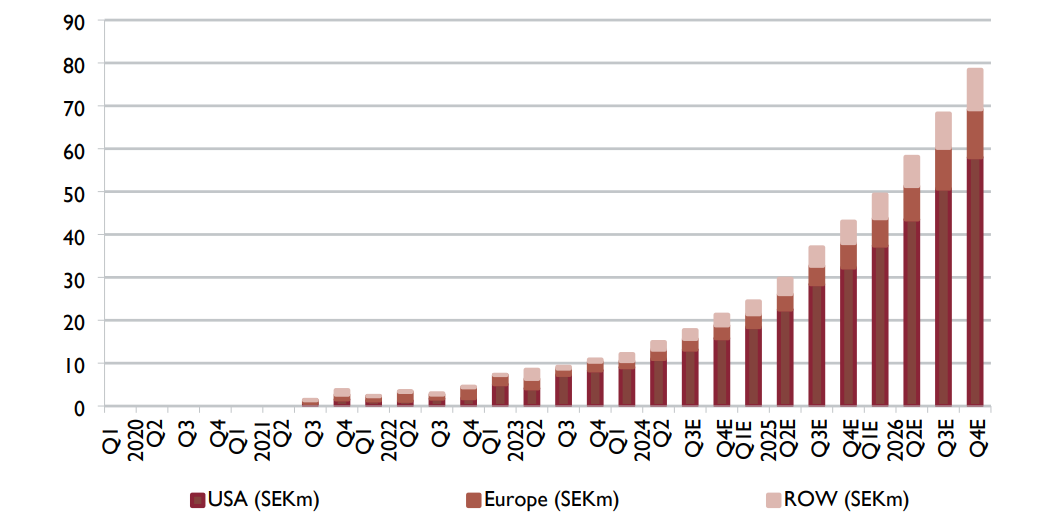

Currently, most sales are concentrated in the U.S., which is expected to remain the primary market in the coming years. However, its share is projected to decline, aiming for a target of 50%.

A R&D-driven innovation

TetraGraph offers minimal variation in data acquisition combined with exceptional accuracy. While competitors may achieve comparable results, TetraGraph stands out with the lowest variability, ensuring comfort and efficiency during surgical procedures.

Senzime's advanced technology is safeguarded by over 100 patents, with a commitment to consistently expanding its patent portfolio. In 2023 and 2022, R&D expenditures amounted to 19 million SEK, up from 12.5 million SEK in 2021. This upward trend is expected to continue in the coming years, focusing on enhancing existing technologies and developing new applications.

Dilution and FCF

Currently, the company has negative FCF, which is not surprising given the need to finance growth and its relatively early-stage investment.

Historically, dilution has been significant, with the number of shares outstanding increasing tenfold since 2015. However, as the company continues to grow, the need for dilution has diminished. In September, the company raised 85 million SEK, resulting in an 11.5% dilution. This funding should be sufficient to support operations through 2025.

The company is expected to achieve positive FCF by 2026, but one to two additional rounds of dilution, similar in amount, may be necessary. This is an important consideration for investors.

Additionally, it is noteworthy that floating shares account for 52% of the total shares.

Potential market and outlooks

The target market encompasses 15,000 hospitals, with 370 currently utilizing Senzime's solutions. This represents a potential market of approximately 100 million patients and 400,000 anesthesia workstations.

The company aims to achieve revenues of 250 to 350 million SEK by 2026 while also becoming cash flow positive.

In the long term, Senzime targets revenues of 1 billion SEK within the next 5 to 7 years, which translates to:

A 100% revenue CAGR from 2023 to 2026

A revenue CAGR of 29% to 53% from 2026 during the subsequent growth phase to reach 1 billion SEK

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.