Screened and Scored: Here Are My Top Canadian Stock Picks

A data-driven stock screening across the Canadian market

I have been meaning to do a deep dive into the Canadian stock market for years, and I am excited to finally share the results of my screening and selection process today. While I have not covered the entire market just yet, I have already analyzed dozens of stocks and narrowed down a list of my top picks.

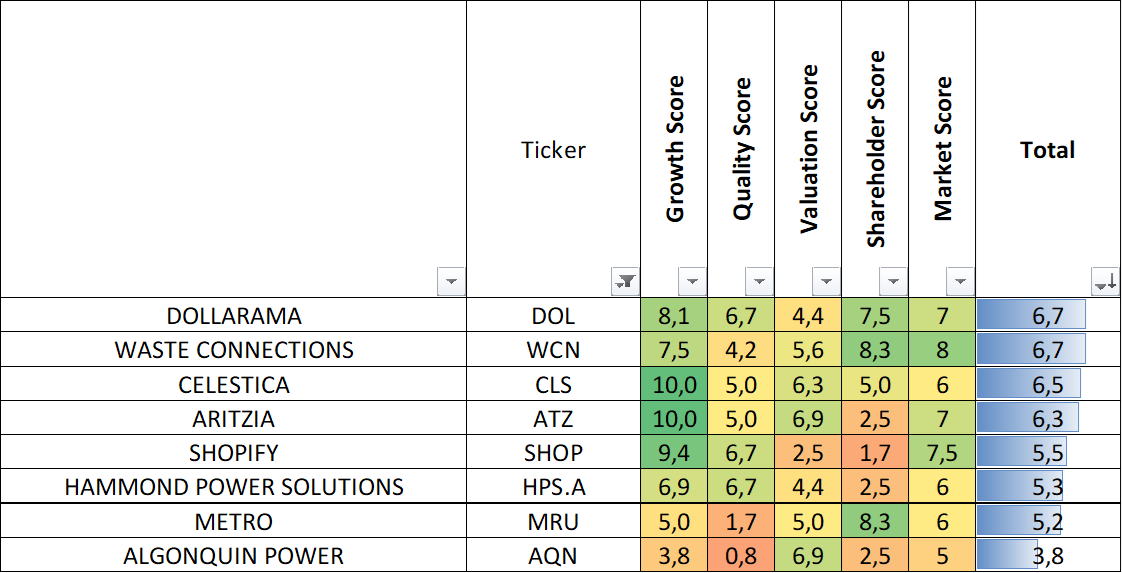

In this article, you will find a curated selection of 34 Canadian stocks, each rated using my personal scoring system. I will walk you through the names that stood out, explain how I assessed them, and of course, reveal my favorites at the end.

If you like screeners, you can find, you can find my US and Europe Quality Screeners just here

The different scores

The screener uses 5 different categories. Each category has different metrics, mainly quantitative. Each metric gives a score depending on thresholds I defined, once again to fit my investment style.

Growth. The growth category uses 4 metrics:

Past and future revenue growth

Past and future EPS growth

Quality. The quality category uses 3 metrics: net profit margin, ROE and cash/debt ratio vs the EBITDA.

Valuation. For valuation, I use 3 metrics: PE, FCF yield and PEG.

Shareholder return. This category shows if the company is shareholder oriented. I look at 3 metrics: dividend yield, dividend growth and buybacks/dilution in outstanding shares.

Market. This is the only qualitative metrics. It represents the value of being present in the market and the company’s strength in it. It is a personal appreciation.

Keep in mind that this scoring system is not designed to pinpoint the absolute best opportunities. To do that, you will need to dive deeper, thoroughly analyze the market, and assess key metrics. Instead, this system helps you identify stocks within your investable universe while highlighting their main characteristics (growth, valuation, quality, …) as outlined in this article.

At the end of the article, among those 34 stocks, I will share my 8 favorite ones.

The screener

In this screener, I have selected 34 of my favorite companies from Canada, using the latest available data for scoring and ranking. The term “quality” is not strictly defined here; it may refer to exceptional metrics, a robust business model, market dominance, or a strong competitive advantage.

Below are 8 stocks available for free subscribers. Access the full screener behind the paywall.

While this newsletter provides valuable content for free subscribers, becoming a paid subscriber unlocks even greater benefits to help you gain an edge in the market.

Here is why upgrading to a paid subscription is worth it:

Access exclusive content. Dive deeper with detailed analyses, advanced insights, and premium research not available to free subscribers

Follow my portfolio. Gain exclusive access to my portfolio, including monthly updates, tracking my moves, and watchlists

Discover more stock ideas. Explore in-depth stock ideas, technical analyses, and strategies tailored to uncover hidden opportunities

Support this newsletter. Your subscription directly supports the creation of high-quality, valuable content to help you achieve your investment goals

Upgrade today and take your investing knowledge and performance to the next level!

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.