Portfolio Update: 3 New Additions + 1 Sale + Reinforcements

2 small-cap stocks and 1 large-cap stock added to the portfolio

As the year draws to a close, I am pleased with the performance of my small-cap portfolio. I remain focused on preparing it for 2025, adhering to the same strategy: I start with a small position in a stock, and if the company performs well and posts strong results, I gradually increase my stake.

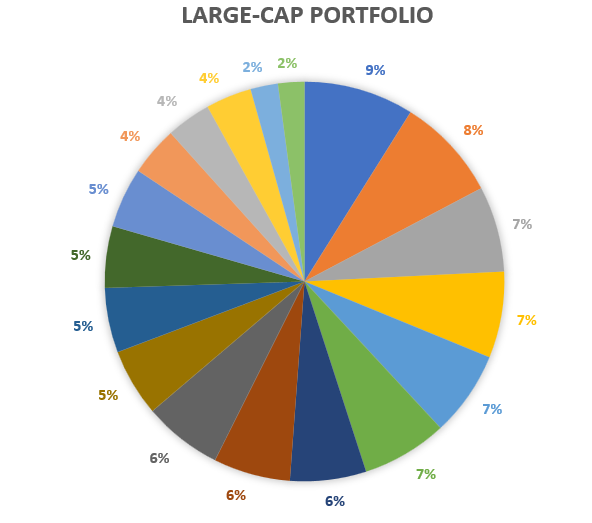

Additionally, I have added a new stock to my large-cap portfolio as part of my preparations for 2025. Over the past few months, I have refined the portfolio by removing underperforming stocks, allowing me to focus on those with greater potential. It reflected on the portfolio metrics like expected growth or potential total shareholder return.

Since its inception in late February 2024, my small-cap portfolio has delivered strong performance, achieving a +32.4% gain.

In terms of strategy, there is a clear distinction between my small-cap portfolio, which is relatively concentrated, and my large-cap portfolio, which is rather equally weighted. Each has distinct objectives:

The large-cap portfolio focuses on identifying stocks with long-term potential and a strong competitive advantage.

In contrast, the small-cap portfolio is more dynamic, targeting early-stage growth stocks with the potential to become 2, 3, or even 10-baggers. While this approach carries higher risk, it offers the potential for greater rewards.

I added 3 stocks to my portfolios (2 small-caps and 1 large-cap). I also reinforced 3 other stocks as they reached interesting buying zones.

The calculated potential total shareholder returns of the 3 new additions are:

20.6%/year for the first one, a Swedish small-cap stock

17.9%/year for the second one, an US small-cap stock

14.4%/year for the third one, a Danish large-cap stock

In this article, the two new additions I made last month. One of them, a US small-cap, has already delivered a 60% return in just one month.

Before we dive in, to access all my content, including analyses, in-depth reports, screeners, and portfolio updates, subscribe to Quality Stocks on Substack. Save over 30% with an annual subscription!

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.