Renowned for their immersive strategy games and captivating historical simulations, Paradox has managed to carve out a niche in the gaming industry with a strong community but has also become an interesting quality stock in the gaming sector

In this article we will describe the business of Paradox interactive and its games, its main competitive advantages. We will analyze the risks and opportunities the company is facing. At the end, after a metrics review, we will identify its fair price.

If you like the gaming industry, here is an article describing the whole sector, its outlooks and the main actors.

I am dedicated to providing quality content, and I invest significant time and resources, including utilizing platforms like Seeking Alpha.

To support this newsletter, I am excited to announce that Seeking Alpha will sponsor one post each month, which will be available to all readers for free. If you interested to discover Seeking Alpha, access to deep-dive research and database, you can click the link.

Stay tuned for insightful, sponsored content that will help you stay informed and ahead of the curve!

Company overview

Paradox is present at several points along the value chain. Paradox owns most of its franchises like Cities Skylines, Stellaris and so on. It is both a developper (with 6 proprietary development studios) and a publisher. Its games are then sold by distribution platforms like Steam.

With more than 600 employees, the company develops new titles, sequels of existing franchises, adapts existing titles to new platforms and produces downloadable content for existing titles.

The organization is divided as follows:

Paradox Interactive is the global publisher brand.

There are 6 developments studios, each team developing its own game and universe:

Paradox Development Studio is the main development studio and is based in Sweden. It consists of 4 sub-studios: PDS Green (Stellaris), PDS Red (Victoria), PDS Black (Crusader Kings) and PDS Gold (Hearts of Iron). They are also in charge of other games like Europe Universalis.

Paradox Tectonic is a smaller studio based on California developing Life by You, a new franchise.

Paradox Tinto, based in Spain, is in charge to develop Europa Universalis IV.

Iceflake Studios, based in Finland, develops Surviving the Aftermath.

Playrion Game Studio, based in France, is the mobile game studio and develops Airline Manager and Airport Simulator.

Triumph Studios, based in Netherlands, develop Age of Wonders.

The games

Paradox focuses on strategy and management games. Paradox games do not finish, allowing countless hours of play and creating strong communities. This supports also a huge DLC (downloadable content) strategy creating additional and long-lasting revenues after the launch of the game.

Paradoxed defined 5 pillars for their games:

Agency. Paradox games give players the freedom to customize their games creating their own stories.

Living worlds. The games feature dynamic and reactive worlds. No 2 games will look the same.

Inviting. Efforts are necessary to learn the games creating a feeling of progress, keeping players engaged.

Cerebral. The games focus on mind before reflexes.

Endless. You can always come back for another playthrough or in some games there is no end state at all.

Wargames

Wargames give the player the control of a nation fighting for world domination. Exploration, trade, economy, warfare and diplomacy are the main themes of theses games.

4 franchises cover different historical periods:

Crusader Kings takes place in the Middle Ages

Europe Universalis from the 15th to the 19th century

Victoria from the 19th century to 1936

Hearts of Iron from 1936

Fun fact, it is possible to begin a playthrough in Crusader Kings and finish it in Hearts of Iron using the same save file.

Stellaris

Stellaris is a space strategy game allowing the player to explore, discover and interact with a multitude of species as it journeys among the stars.

Age of Wonders

Age of Wonders is a tactical fantasy where the player rules its own kingdown. It is a 4X (explore, expand, exploit, extermine). The gameplay is turn-based.

Cities: Skyline

Cities: Skyline is a city building game where the player raises a city from the ground up and transform it into a thriving metropolis.

Other games

A lot of other games exist. Here is a non-exhaustive list: Star Trek Infinite, The Lamplighters League, Empire of Sin, Airport Simulator, Prison Architect, Surviving Mars, Knights of Pen & Paper.

The reasons behind Paradox Interactive’s success and the potential limits

First, let’s begin to identify some success metrics showing Paradox Interactive’s success:

2015 sales: $71.8M / 2023 sales: $242M - A 16.4% CAGR

2024 net margin should be around 27%, above most of its competitors

Electronic Arts 16.5% / Sony 7.5% / Nintendo 27.5% / Ubisoft 6.9%

29.2% 5y average ROIC, once again above most of the competition

Electronic Arts 16.4% / Sony 11.8% / Nintendo 21.6% / Ubisoft (-1.7%)

5 main reasons are behind this success:

Unique Game Concept. Grand strategy and simulation games are a niche and no other players have the recognition of Paradox for that

Low development costs. With very simple visuals, development costs are low, limiting the risk in case of disappointing sales

Strong engagement and longevity. Players can play the same game for years with an engaging gameplay

Additional sales. Offering a lot of DLCs allows Paradox to get additional sales. They also have a subscription offer creating stability in their revenues

Strong community. The community is very strong around the games, helping marketing and engagement.

However, despite these positive aspects, there are some elements to take into account that could be an issue for Paradox:

Limited market. Paradox may have reached a size where it may be hard to grow at the same speed. Expected annual growth between 2023 and 2026 is 5.5% (vs 16% for the last 8 years!). M&A and new franchises may be necessary but this won’t be easy

Development risks. To grow further the company will have to develop new games. To reach a broader public, graphics will be one of the keys - and graphics are very expensive, increasing risks in case of failure

Of course, the company has huge financial resources (SEK1.77B in net cash position) for studios and franchises acquisitions.

An example of the risk is the acquisition of the World of Darkness universe to create videogames. Vampire, the Masquerades: Bloodlines 2 could be a huge success and significantly increase the revenues of the company. The developper is the Chinese Room an English studio.

However, the game was almost cancelled and the delay will be important. It is set for Fall 2024 - the success or the failure of this game will be very interesting to identify the capabilities of Paradox to publish games outside of its classic genre.

Stock metrics

Growth metrics

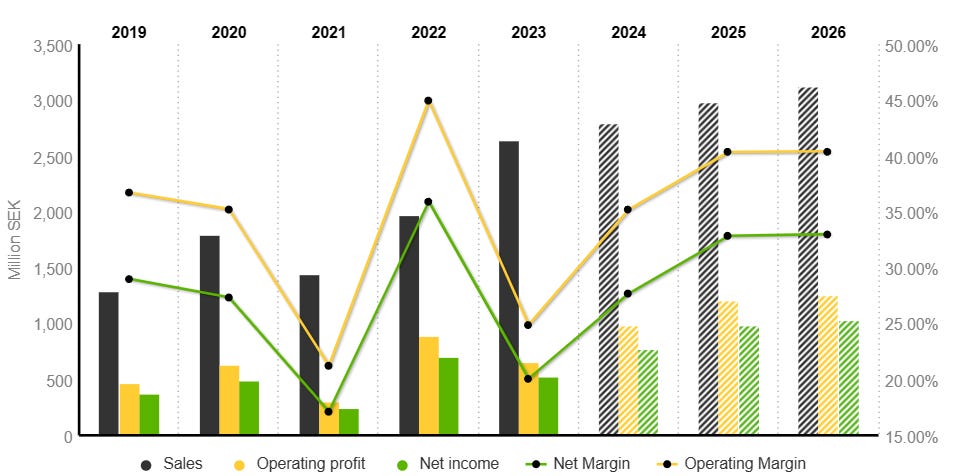

2019-2023 revenue CAGR: 19.7%

2019-2023 net income CAGR: 19.0%

2023-2026 expected revenue CAGR: 5.5%

2023-2026 expected net income CAGR: 9.2%

As we saw, growth is slowling. New growth drivers will be necessary!

Quality metrics

Net profit margin for 2024: 27.1%

FCF conversion: 114%

5y average ROE/ROIC: 31.9% / 29.2%

Cash: SEK1.77B or 0.9x EBIDTA

Ultra high quality proving the efficiency of the company and the relevance of their business model.

Valuation metrics

PE24: 22.1x / PE26: 16.2x

FCF yield 23: 5.57% / FCF yield 25: 6.35%

The company is not too expensive but without new growth drivers, valuation ratios may decrease.

Shareholder metrics

Dividend yield: 2.01%

Payout ratio: 45%

Dividend 2019-2023 CAGR: 24%

Share buyback 2019-2023 per year: 0%

Excess cash is used for dividends. No buybacks.

Fair price calculation

I use 3 ways to identify my fair price: “fair PE” valuation, DCF valuation and analyst target.

“Fair PE” valuation

The fair PE is around 21x.

Base PE is 15 + 0 for moat + 2 for brand + 0 for growth + 2 for market + 2 for margin + 0 for consistency.

This gives a price of 150SEK.

DCF valuation

Using a 10-year growth of 8.5% then a 10-year terminal growth of 4%, with a discount rate of 11%, the stock value should be 203SEK.

Analyst target

The analyst consensus gives a target price of 242SEK.

Result

The average of these 3 methods is 198SEK around 30% above the current price.

Conclusion

By developing games with strong, addictive concepts and significant longevity, Paradox has carved out a prominent place in a niche market. This enables the company to generate significant revenues with a certain stability that some of its competitors lack. Moreover, it is in an advantageous position to go further by developing new concepts or acquiring independent studios that align with its strategy.

The company is at a pivotal moment where it will need to find new growth drivers. This risk could weigh on the company's valuation. However, this risk could also be seen as an opportunity by investors.