On the Hunt for Multibaggers, Episode 3

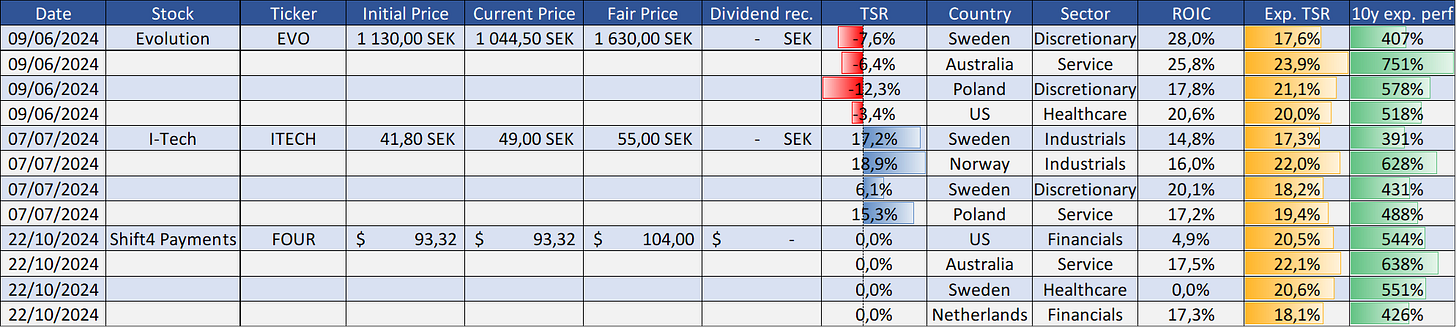

Adding 4 new stocks to the list of potential multibaggers

Stocks that give returns that are several times their costs are called multibaggers. In this series, "On the Hunt for Multibaggers," we will identify and track potential multibagger stocks.

Our selection process will include:

Strong Growth: Companies exhibiting robust growth in expanding markets.

Proven Profitability: Profitable companies with established, successful business models.

Valuation Metrics: Reasonable P/E ratios and PEG ratios around or below 1.

Healthy Profit Margins: Companies with decent net profit margins.

High ROIC: Great Return on Invested Capital, a crucial metric for sustained growth.

Minimal Dilution: Companies with no significant share dilution.

In each episode, we will introduce new potential multibaggers and revisit previous picks to assess to see if the selection process was effective and what were their return. The investment horizon is 10 years.Free subscribers will discover one stock per episode, while the remaining three stocks will be exclusive to paid subscribers.

Please note, this is for informational purposes only and is not intended as investment advice.

Here you can find the 2 first episodes:

Shift4 Payments

Shift4 Payments is a leading provider of payment processing solutions, specializing in integrated payment technology for various industries, including hospitality, retail, and e-commerce. The company offers a comprehensive suite of services, including point-of-sale systems, online payment gateways, and mobile payment solutions. The company has been actively expanding its market presence through strategic acquisitions and partnerships, positioning itself as a significant player in the rapidly evolving payments landscape.

Country: USA

Sector: Financials / Technology

Metrics

2024 growth 38.6% / 2025 growth 29.9%

PE 35.6x / PEG 0.92

Net profit margin 6.0%

ROIC 4.9%

Dilution-5.4% / year

Leverage 2.0x EBITDA (debt)

Calculated future total shareholder returns 20.5% / year

Calculated 10y performance 5.44% (x6.5)

To discover other stocks and the entire Substack, you can subscribe. The annual subscription offers a discount of over 30%.

You will find a wealth of resources: stock analysis, screeners, portfolio sharing, industry analysis, one-pagers, stock duels, and much more to help and inspire you to improve your investments, discover hidden gems, and stay informed about the stock market.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.