Off the Radar, ep. 1: Stocks You Have Probably Never Heard Of (But Should Know)

A new series to surface hidden gems and future leaders

Let’s be honest, most stock talk revolves around the same handful of tickers. Nvidia, Apple, Tesla... you know the drill. Great companies for sure. But sometimes, the magic is happening where nobody’s looking.

I already write a lot about lesser-known stocks. But I decided to begin a new series “Off the Radar”. Every so often, I dig into the depths of the market to uncover lesser-known companies quietly doing impressive things: growing revenues, disrupting industries, or building moats while staying out of the spotlight. No hype, no meme stock madness. Just real businesses flying under the radar… for now.

Please note that I don’t necessarily invest in those names, but it is interesting to regularly screen the stock market for potential opportunities. Rest assured, my main rule still stands: quality stocks only!

Some of these names might surprise you. Others might make you say, “Wait, how have I never heard of this?” Either way, they are worth a look.

Ready to meet this first edition of “Off the Radar” and discover 3 new gems? Let’s dive in!

1. Energy One (ticker: EOL.AX)

Country: Australia

Metrics

📈 2025 growth 17.3%

💎 Net profit margin 9.8%

💰 2025 PE 67x

🎁 Dividend -%

Rating

Growth ⭐️⭐️⭐️

Profitability / balance sheet ⭐️⭐️

Valuation ⭐️

Business model ⭐️⭐️⭐️

Risk ⚠️⚠️

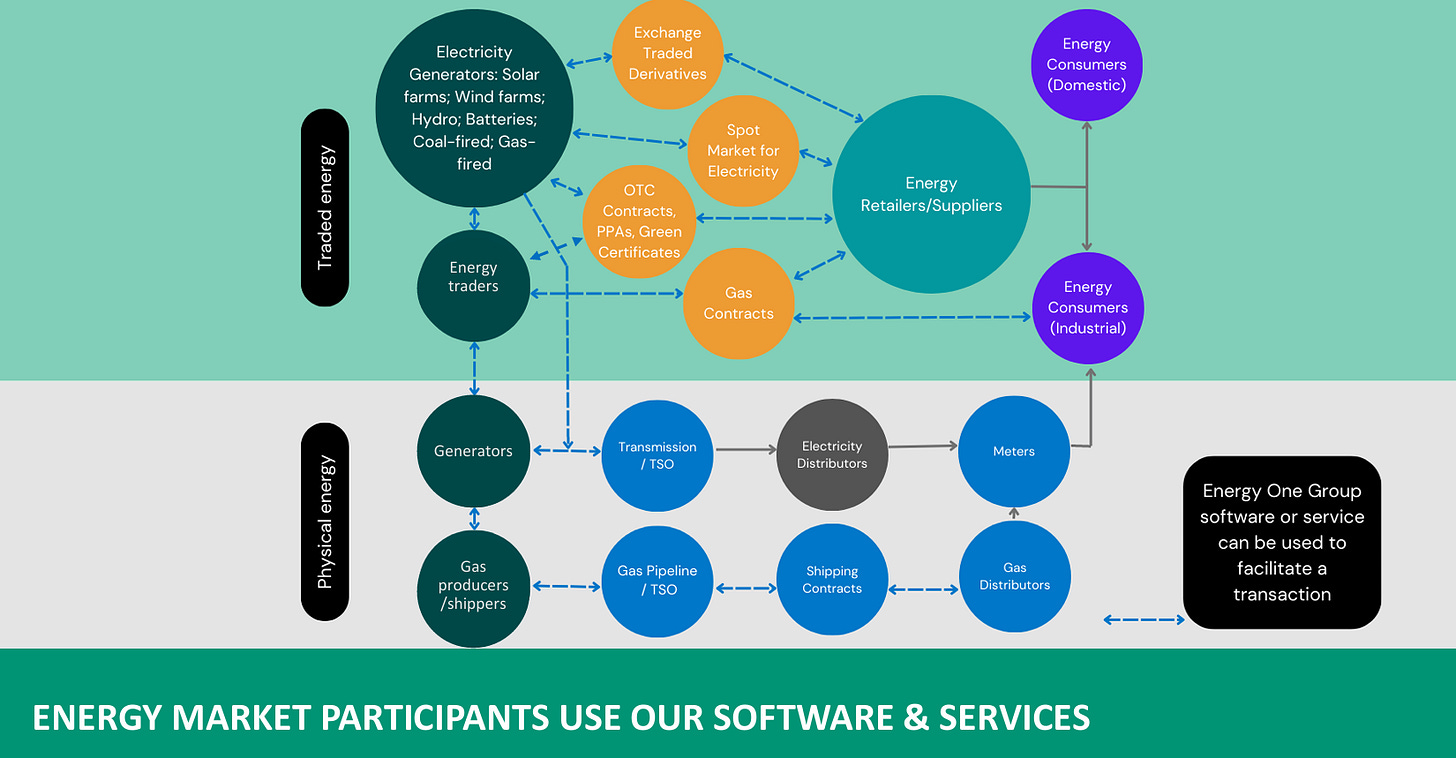

What do they do? Energy One provides software and services for wholesale energy markets helping customers navigate and accelerate the carbon transition with smart tech solutions. 90% of the sales are recurring (subscription fees, trading and other services). 10% of the sales are non-recurring (project, advisory)

Market dynamic. Underlying market grows above 10% a year. 50% market share in Australia, 15% market share in UK, less than 10% in Europe so a lot of room for growth

🐂 Bull case

Growing market

Strong position in Australia

Moat: network effet, switching costs

Potential acquisitions (to grow or as a target)

🐻 Bear case

Relatively small

Risk of disruption or coming from competition

Regulation might slow down the company (or accelerate it)

Expensive

Want to discover the 2 other off-the-radar stocks? (1 US stock and 1 Swiss stock listed in the US)

Subscribe now to unlock the full article, plus get access to everything the newsletter offers: deep-dive analysis, portfolio tracking, screeners, and exclusive insights.

👉 Join now and get your edge in the market

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.