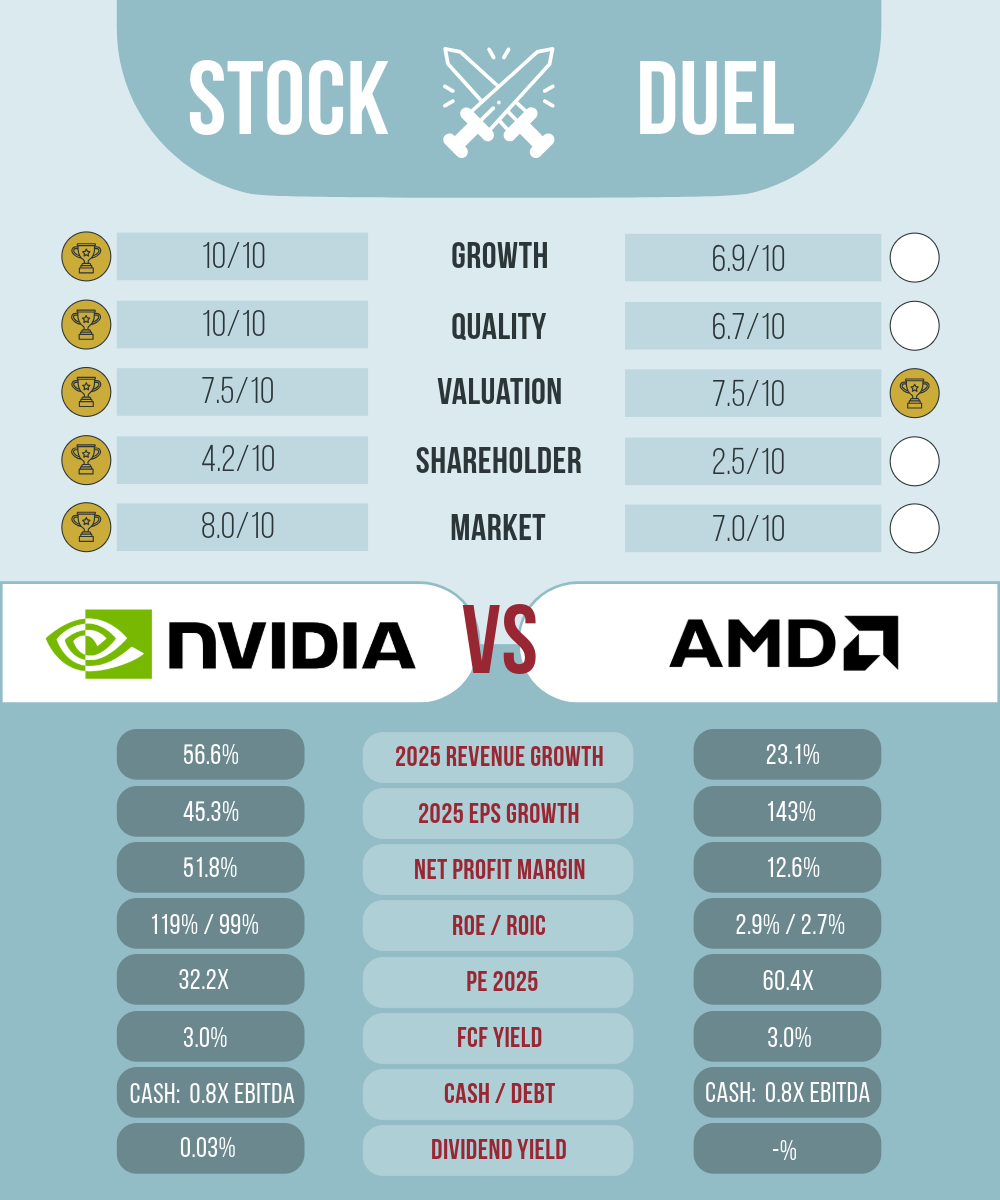

NVidia vs AMD: a Stock Duel

Which is the more compelling stock: the leader or the challenger?

Ladies and gentlemen, the moment has arrived for our fourth stock duel: AMD vs. NVidia. At the heart of the AI revolution, both companies boast strong growth and promising outlooks. But which one stands out as the more compelling opportunity? Let’s find out.

If you enjoy stock duels, don’t miss the 3 first ones!

Share your thoughts on both companies in the comments below!

Metrics and markets

NVidia (ticker: NVDA) outperforms AMD (ticker: AMD) across nearly every category, from growth to valuation metrics.

However, given NVidia’s staggering market capitalization nearing $3T, the stock carries substantial risks, as I previously detailed in this article. In short: NVidia operates within an equipment sector, which is inherently cyclical and exposed to significant competitive pressures. For now, however, NVidia clearly dominates a booming market and its domination is very clear.

AMD, with a more modest market cap of around $190B and a price-to-sales (PS) ratio nearly three times lower than NVidia's, could represent an interesting opportunity.

Nonetheless, AMD shares many of NVidia’s cyclical and competitive risks. Moreover, it faces an additional challenge: as a second-place contender, it bears the risk of failing to catch up in a race where it is not the market leader.

Both companies receive strong ratings and could make compelling investments. Nvidia clearly leads with stronger financials and market momentum. Yet, investors must remain cautious and avoid getting swept up in the current frenzy surrounding AI-related stocks.

Technical analysis

Used source: Marketscreener.com. Affiliate link just here

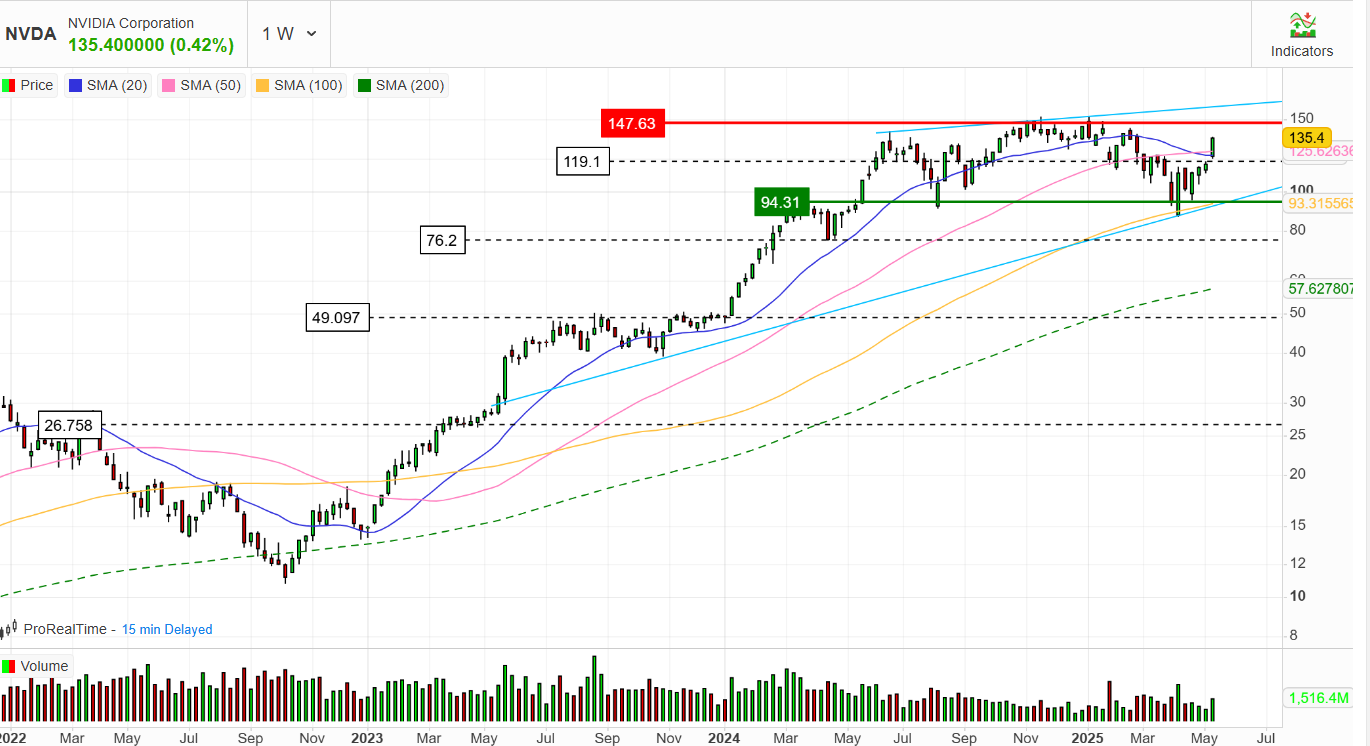

NVidia

The trend is highly positive:

Buying zone 1: $90

Buying zone 2: $76

Buying zone 3: $49

AMD

Despite a recent bounce back, AMD shares are almost down 50% from their ATH

Buying zone 1: $75

Buying zone 2: $56

Buying zone 3: $39

While this newsletter provides valuable content for free subscribers, becoming a paid subscriber unlocks even greater benefits to help you gain an edge in the market.

Here is why upgrading to a paid subscription is worth it:

Access exclusive content. Dive deeper with detailed analyses, advanced insights, and premium research not available to free subscribers

Follow my portfolio. Gain exclusive access to my portfolio, including monthly updates, tracking my moves, and watchlists

Discover more stock ideas. Explore in-depth stock ideas, technical analyses, and strategies tailored to uncover hidden opportunities

Support this newsletter. Your subscription directly supports the creation of high-quality, valuable content to help you achieve your investment goals

In my view, AMD will eventually offer a full AI development platform. Chinese software firm DeepSeek has already shown that skilled engineers can write low-level optimizations to make traditionally “weaker” NVIDIA GPUs train AI models far more efficiently. I expect those same techniques to be applied to AMD hardware. In fact, George Hotz’s Tinygrad project is already hard at work commoditizing petaflop-scale training on GPUs—proof that open, high-performance AI stacks on AMD are within reach.