My Main Investment Themes for the 2025 Stock Market

2025 is likely to experience increased volatility

The review of 2024 done, it is time to identify what will the main 2025 themes be. Of course this is a forecast exercice so I can always be wrong, but this can help you be prepared and develop scenarios.

What might happen in 2025? Let’s find out!

The Trump Effect and increase volatility

Trump will be a major source of market volatility in 2025. During his first term, we saw how a single tweet could significantly impact the stock market. This behavior is expected to continue in 2025.

The volatility in the market is very difficult especially for individual investors. However this volatility can create opportunities

Geopolitical tensions

As geopolitical tensions escalate, nations are prioritizing advancements in their military capabilities. In Asia, the ongoing tension between China and Taiwan poses a significant challenge. Meanwhile, Europe faces the necessity of strengthening its defense infrastructure, including building a unified military force. This urgency is further underscored by Trump's policy: nations seeking NATO's defense must contribute proportionately to its funding.

Inflation is not dead

Despite several rate cuts, inflation remains persistent, particularly in the US, where economic growth continues to be robust. Growth in 2025 is projected to reach approximately 2.5%, a strong pace compared to other countries, especially given the prolonged period of high interest rates pressuring the economy.

This sustained level of inflation will likely prevent the US Federal Reserve from aggressively cutting rates in the short-term. In contrast, the European Central Bank (ECB) faces a very different scenario, as the European economy is significantly weaker than that of the US. As a result, the interest rate gap between the two regions is expected to widen further in 2025.

AI, a focus on efficiency and monetization

AI will certainly remain a key driver of the markets. However, following a year dominated by hyperscalers and chip manufacturers, the focus may shift next year toward efficiency and monetization.

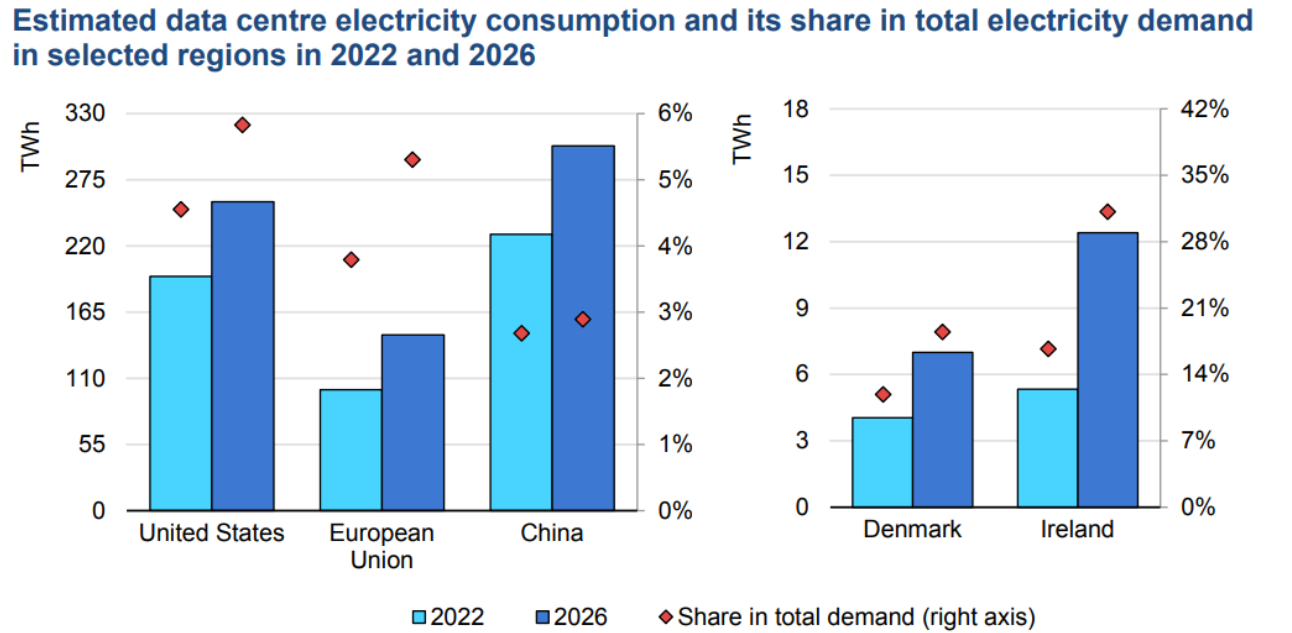

Efficiency will play a critical role in reducing costs, improving profitability, and addressing energy consumption challenges. As discussed in this article, data center energy usage is projected to rise significantly in the coming years. Power grids are not equipped to handle such an increase, making it imperative for tech companies to optimize the performance of their AI models. Enhancing efficiency will not only mitigate energy demands but also improve the sustainability of AI-driven innovations.

In the meantime, software companies will continue to integrate and monetize AI, as companies like Adobe, ServiceNow, and Salesforce are already doing. While their current gains are growing, the majority of AI-driven revenue today is concentrated in hardware companies (like NVidia) which power the computational needs of AI. Over time, the software sector will play a major role in creating a new AI-driven economy, creating substantial value as AI tools and applications become more widespread.

Infrastructure

Infrastructure is poised to benefit from increased government funding aimed at building for the future. Clean energy, in particular, is expected to continue its growth trajectory, making it an area worth considering after several harsh years.

Nuclear energy has also garnered significant attention, not only from governments but also from major corporations like Amazon, Microsoft, and Alphabet, which are exploring nuclear power to fuel their data centers. This renewed interest signals a promising opportunity for long-term investment.

Additionally, if interest rates continue to decline (even at a slower pace than anticipated) the construction sector could see renewed momentum. This would positively impact related industries such as industrial metals and construction materials, creating opportunities across the supply chain.

The return of overlooked sectors / themes

Several sectors and themes are currently undervalued, presenting potential opportunities for investors. Notable examples include healthcare, Europe, China, luxury, industrials and small-caps.

Each of these themes has the potential to rebound significantly, or they may remain undervalued for some time. Among them, healthcare stands out as a compelling choice for me. It is a defensive sector but it currently offers reasonable valuations after years of underperformance. Furthermore, the market could experience significant volatility next year, increasing the interest to add healthcare stocks in any portfolio (resilience, stable revenue streams and strong free cash flow).

Expensive US market = risks?

Valuations (in the US market) are high by historical standards and may be a risk for investors. The PE multiple of the S&P 500 index has increased by 25% during the past two years. Today, the PE multiple is around 22x (above the ninth historical decile). At the end of 2022, the index traded at around of 17x.

So what will be the direction next year? No one knows! Major banks forecast a 10% increase, aligning with historical averages. However, such forecasts are merely projections based on past performance. Given the uncertainty, its crucial to remain cautious and prepared:

Avoid selling out of fear. As Peter Lynch said, “Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.” Avoid making hasty decisions in anticipation of a downturn.

Be selective when buying. Avoid buying indiscriminately at any price. Always be discerning with your investments, focusing on fundamentals and valuation. If necessary, increase your cash reserves to maintain flexibility.

Prepare for different scenarios. Create plans for a variety of potential market outcomes to remain calm and disciplined:

Scenario 1: immediate consolidation. The market experiences a sharp correction at the beginning of the year, similar to 2022. In this case, you wait for attractive buying opportunities and deploy your capital progressively.

Scenario 2: continued euphoria. The market continues its upward trajectory, reaching new highs throughout the year. Stay invested but remain vigilant, seeking individual stock opportunities rather than broad exposure.

Scenario 3: mid-year euphoria and correction. After a small consolidation, the market rallies on continued strong US economic growth, leading to euphoria. However, by May or June, a significant correction triggers a bear market. In this case, you begin with scenario 2 and then transition to scenario 1 when the correction occurs.

Focus on fundamentals. In all cases, maintain a calm and rational approach. Prioritize the quality and the fundamentals of the companies you invest in and their underlying fundamentals, filtering out the noise of market speculation.

Some potential black swans

A black swan is an unpredictable event with a massive impact on the market, and its consequences are often only understood after it happens. By definition, it is impossible to predict black swans, but several potential events could have huge consequences for the stock markets in 2025. Here are some possibilities:

Debt crisis. A sovereign debt crisis in a major economy (US, France or Italy for instance) could begin a financial chain reaction similar to the 2008 financial crisis

War between major powers. Geopolitical tensions are high, and there is a risk that they could escalate into a larger conflict. The use of nuclear weapons by minor powers could also have a severe negative effect on markets

Large-scale cyberattacks on critical infrastructure (energy, financial). Cyberattacks targeting key infrastructure, such as energy grids and financial systems, could disrupt markets significantly

Stronger than expected commercial war. Trump is a skilled negotiator, and many expect that tariffs will be used as leverage rather than being fully implemented. A full-scale trade war, however, could significantly impact global economic growth

Don’t forget the secural trends

Rather than chasing the next big idea for the coming year, it is more important to focus on sectors and companies that benefit from long-term secular trends. This approach is not only simpler but also likely more effective in achieving sustainable returns.

Some of these enduring themes include cloud computing, digitalization, population aging, cybersecurity, middle-class expansion, digital payments or e-commerce.

By concentrating on the right themes and adopting a long-term perspective, holding quality stocks for 10, 20, or even 40 years, you can navigate the stock market with greater confidence and ease, building wealth steadily over time.

You were spot on, my friend!

Why do you think clean energy in particular will see a boon after years of harsh correction?