Monthly Portfolio Update - May 2024

A month of consolidation after a strong start of the year

Hello fellow investor,

In this section, I present a transparent monthly update of my portfolio. It follows my investment strategy that you can find here.

This presentation is divided into several parts:

Global view of the valuation and the portfolio’s metrics

For dividend lovers, presentation of the Projected Annual Dividend Income (PADI) and a monthly calendar

Sector and geographical breakdown

For paid subscribers, there is also:

An explanation of the month's movements

Review of the month's news

Presentation of current portfolio

My reinforcement price for potential stock purchases

Please note that my portfolio is in euros, so I am subject to exchange rate fluctuations, especially the euro-dollar exchange rate.

Overall Performance

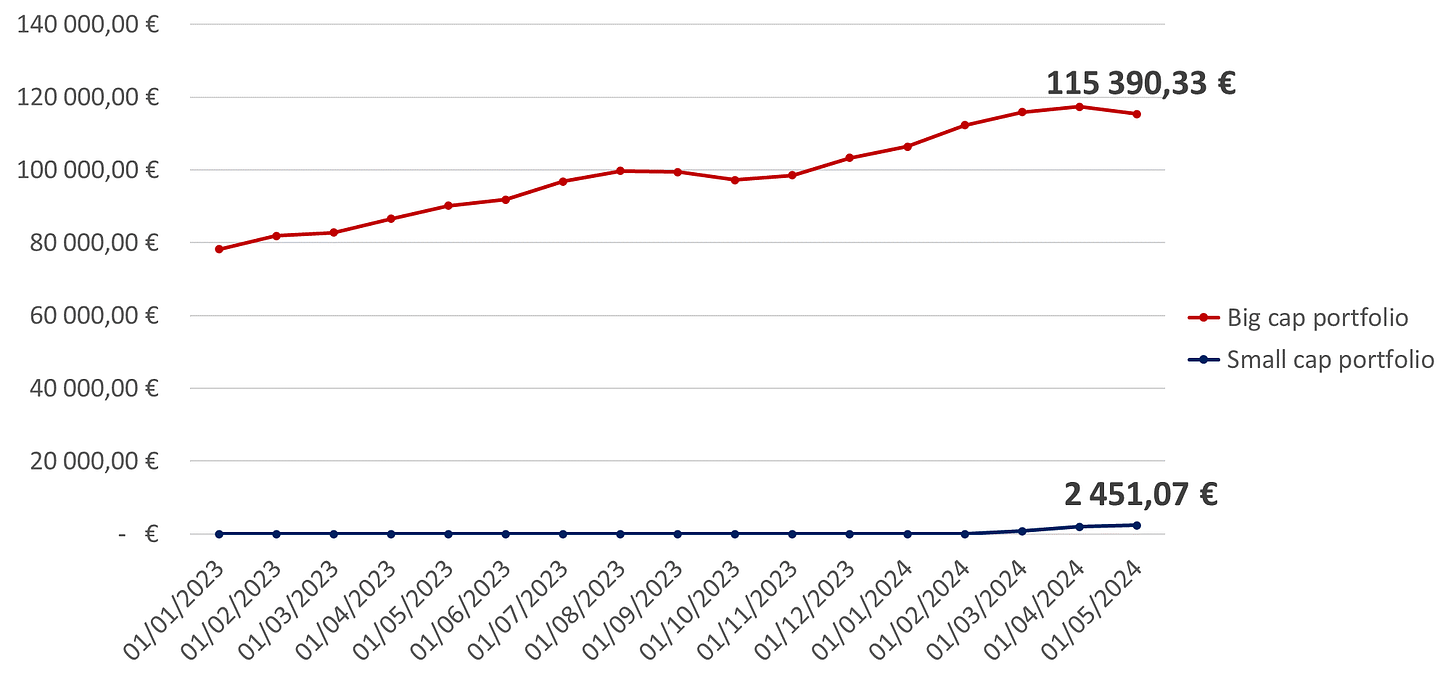

After a strong start of the year, a consolidation happened with some huge positions of the big cap portfolio. For instance Microsoft has a 1-month performance of -7.46% but is still up +3.53%.

The quality segment took a huge hit but I remain confident over the long-term. This consolidation created opportunities (including my last buy at the end of April) and if it continues, will create more! I will probably add to my existing positions in May instead of opening new ones.

Valuation and metrics

The overall (big cap portfolio + small cap portfolio) monthly performance is -4.84%. This explain the drop in valuation (despite +3,100€ of cash addition).

The small cap portfolio performance is better with +1.38%. This is interesting especially after a difficult start of the month! For now, there are 6 stocks in this small cap portfolio and it is still under construction.

Here are the portfolio’s key metrics (weighted average):

Past growth: 12.4% / Estimated future growth: 9.5%

Net profit margin: 24.5%

ROE: 39%

Debt leverage: 0.13x EBITDA

PE: 29.6x / PE Y+2: 22.1x

FCF yield: 3.86% / FCF yield Y+2: 5.22%

Dividend yield: 1.54%

Dividend growth: 9.17%

Buybacks: 0.79%

PADI increased (+47€) mainly with the addition of new positions. I am not focused on PADI increasing and it may even reduce in case of position arbitrage.

Sector and geographical breakdown

And now, it is time to see the stocks in both portfolios!

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.