Monthly Portfolio Update - February 2024

Strong results for the stocks in the portfolio

Hello fellow investor,

In this section, I present a transparent monthly update of my portfolio. It follows my investment strategy that you can find here.

This presentation is divided into several parts:

Global view of the valuation and the portfolio’s metrics

For dividend lovers, presentation of the Projected Annual Dividend Income (PADI) and a monthly calendar

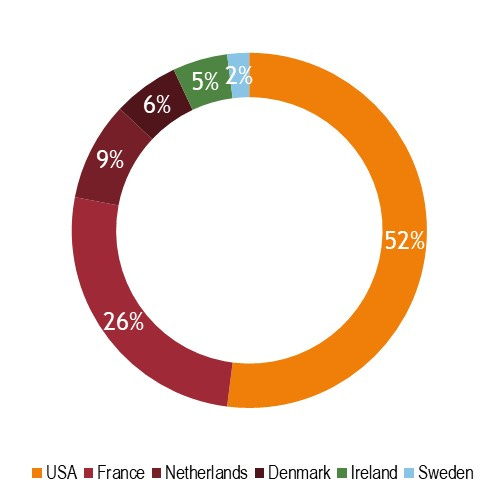

Sector and geographical breakdown

For paying subscribers, there is also:

An explanation of the month's movements

Review of the month's news

Presentation of current portfolio

Please note that my portfolio is in euros, so I am subject to exchange rate fluctuations, especially the euro-dollar exchange rate.

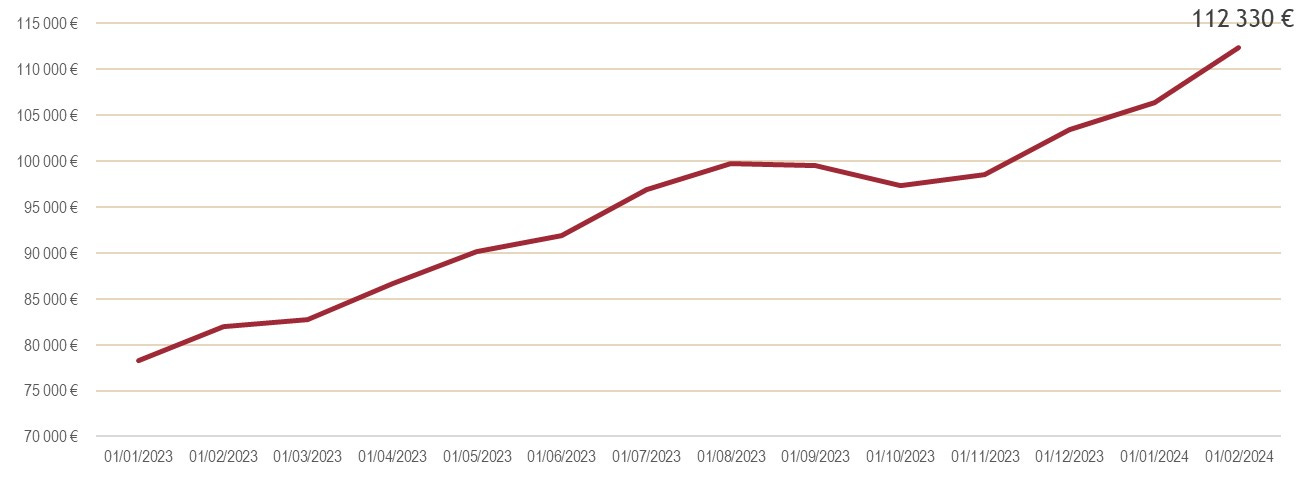

Valuation and metrics

The monthly performance is 5.58%. This is better than most of the indexes (Nasdaq: 3.87% / SP500: 2.06% / CAC40: 1.78% / FTSE100: -1.33% / MSCI World: 2.13%)

Here are the portfolio’s key metrics (weighted average):

Past growth: 11.7% / Estimated future growth: 9.6%

Net profit margin: 24.5%

ROE: 39%

Debt leverage: 0.28x EBITDA

PE: 27.9x / PE Y+2: 21.6x

FCF yield: 3.93% / FCF yield Y+2: 5.27%

Dividend yield: 1.51%

Dividend growth: 9.07%

Buybacks: 0.84%

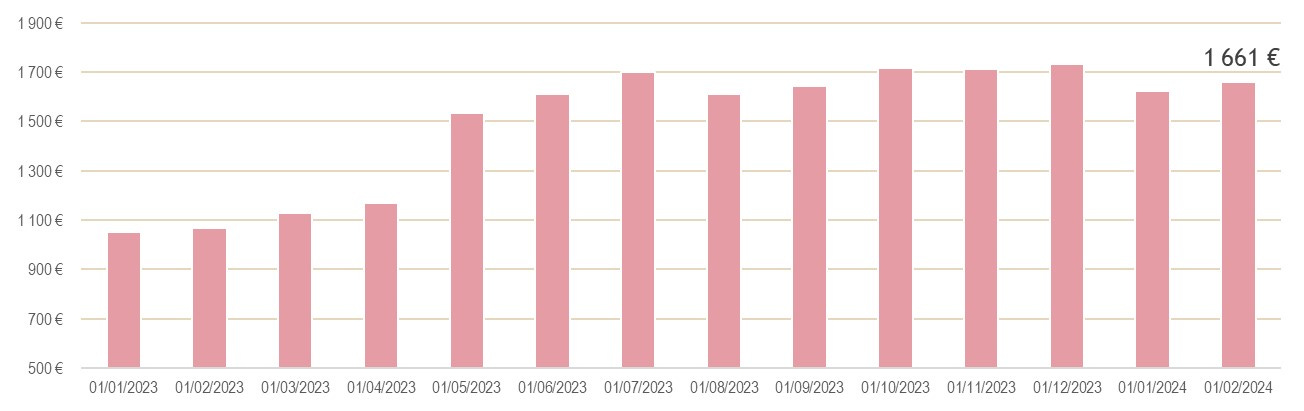

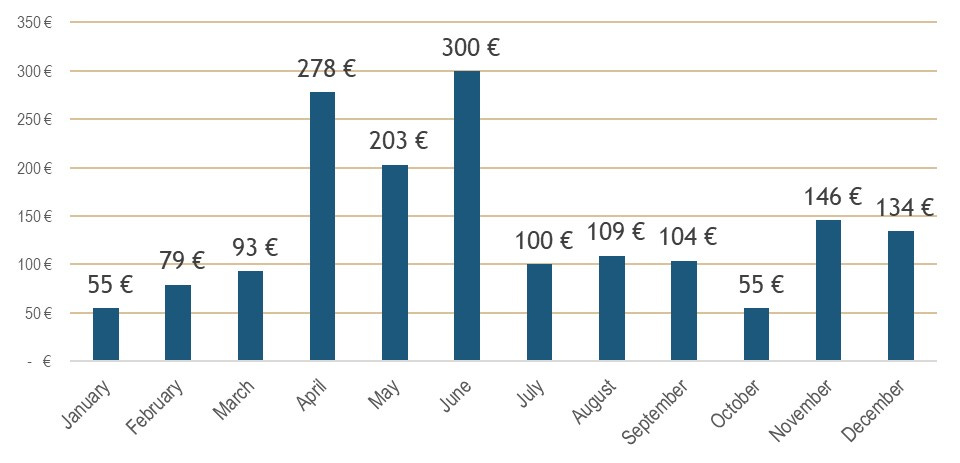

Projected Annual Dividend Income

PADI increased due to 2 elements: dividend hikes (MSCI, etc) and positive EUR/USD exchange rate

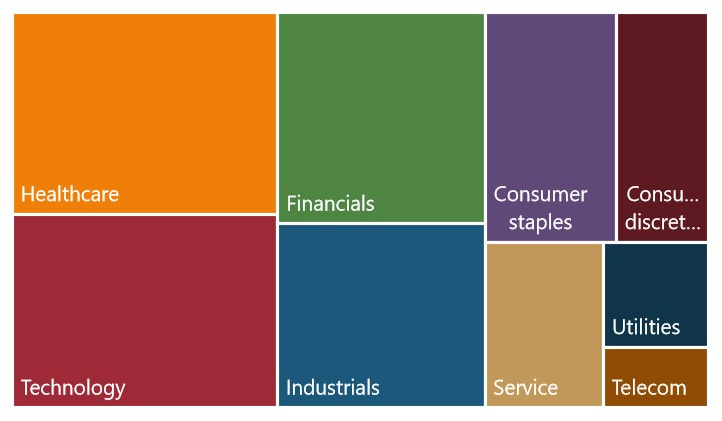

Sector and geographical breakdown

The sector breakdown is decent, even if I would prefer to overweight the healthcare and technology sectors.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.