Investment Knowledge: an Easy Path to Becoming a Contrarian Investor

How to identify potential opportunities and avoid traps?

Contrarian investing is all about going against the crowd. As Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful,” which perfectly encapsulates this approach. However, putting this into practice is often easier said than done.

So, how can you implement contrarian strategies successfully? And what common mistakes should you avoid? Let’s dive in and explore!

What is contrarian investing?

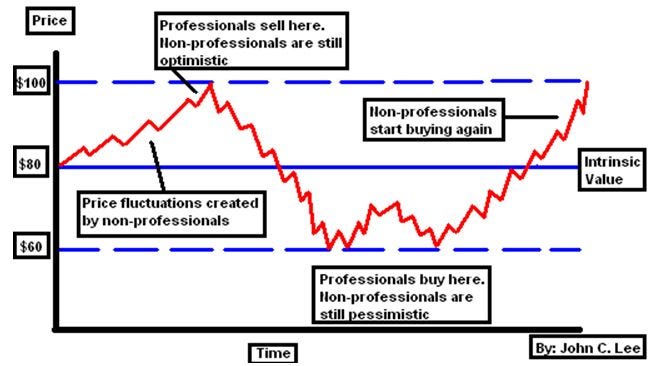

Contrarian investing is an investment strategy where you go against the crowd, buying when others are selling and selling when others are buying. The idea is to capitalize on market overreactions, when fear drives prices too low or hype pushes them too high. It is based on the belief that markets aren’t always rational, and the herd mentality can create opportunities for those willing to think independently.

For example, a contrarian might buy stocks during a market crash when everyone’s panicking, betting that the fear is overblown and prices will rebound. Conversely, they might sell during a bubble when euphoria has inflated valuations beyond reason. Usually retail investors are quite bad as a contrarian investors because they tend to listen to media noise more than professional investors.

Easier said than done! If you oversimplify, contrarian investing looks like buying low and selling high. What an innovation! But we all know timing the market is nearly impossible. So, how can you truly be a contrarian investor? Let’s find out!

How to do it efficiently?

Being a contrarian investor is not just about being different for the sake of it. Successful contrarians dig into fundamentals, like a company’s earnings or assets, to back up their moves.

Identifying market excesses

Identifying market excesses is tough, and predicting how long an irrational rally will last is even harder. A simple approach? Spotting bubbles. I have written a dedicated article on this, featuring PayPal as a key example, check it out!

Of course, beyond bubble patterns, you can also identify overvalued stocks through metrics like a high PE ratio, low free cash flow (FCF), high PEG ratio, and perhaps even more importantly, a low expected total shareholder return (TSR).

Identifying opportunities

For contrarian investors, the real game-changer lies in identifying buying opportunities, moments when the market’s irrationality hands you a bargain. The most effective way to do this is by targeting stocks where the price is trending downward while the underlying fundamentals are strengthening. This combination is critical: a declining price alone could just signal a sinking ship, but pair that with improving metrics (increasing margin, growth, growing FCF) and you have a potential gem.

Miss this balance, and you are risking a classic pitfall: catching falling knives.

Some mistakes to avoid

Contrarian investing can be a powerful strategy, but it is a minefield of pitfalls if you are not careful. Here is a list of mistakes to avoid:

Overanticipating the turnaround. It is tempting to jump into a struggling stock too early, believing a turnaround is imminent. However, markets can remain irrational longer than expected, and what looks like a bargain may still have room to fall

Entering all at once instead of staggering. Buying in one large chunk exposes you to unnecessary risk, especially if the stock continues to drop. A better approach is to identify different buying zones

Failing to admit you are wrong and holding on. One of the biggest dangers of contrarian investing is stubbornness. Just because a stock looks undervalued doesn’t mean it will recover. If new data contradicts your investment thesis, be willing to cut your losses rather than holding onto a losing position out of pride

Chasing momentum instead of value. True contrarian investing is about buying quality assets at a discount, not jumping into falling stocks simply because they have declined. Some stocks are cheap for good reason, weak fundamentals, poor management, or structural decline

Ignoring the bigger picture. A stock might seem undervalued on a micro level, but external factors, such as macroeconomic trends, industry shifts, or regulatory changes, can limit its recovery potential. Always zoom out and consider how broader forces could impact your investment thesis

Conclusion

Contrarian investing requires patience, discipline, and a willingness to adapt. It is not about blindly going against the crowd but about recognizing when market sentiment has created mispricings that offer real opportunities.

To succeed, you need to balance independent thinking with solid fundamentals, identifying market excesses, spotting undervalued assets, and avoiding common pitfalls like overanticipation or emotional attachment to losing positions.

That said, being a contrarian doesn’t mean you should ignore momentum altogether. Sometimes, a strong trend aligns with value, presenting an opportunity to ride momentum in a smart way. The key is knowing when to take a stand and when to go with the flow, always backed by data, not emotion.

Ultimately, the best investors are flexible. Whether you are betting against the herd or riding a wave, the goal remains the same: finding asymmetric opportunities where the risk-reward ratio is in your favor.

What are your thoughts on the contrarian investing? Share that in the comments!

While this newsletter provides valuable content for free subscribers, here is why upgrading to a paid subscription is worth it:

Access exclusive content. Dive deeper with detailed analyses, advanced insights, and premium research not available to free subscribers

Follow my portfolio. Gain exclusive access to my portfolio, including monthly updates, tracking my moves, and watchlists

Discover more stock ideas. Explore in-depth stock ideas, technical analyses, and strategies tailored to uncover hidden opportunities

Support this newsletter. Your subscription directly supports the creation of high-quality, valuable content to help you achieve your investment goals

Nice work.

Very good illustration, thanks! It's still hard to manage own emotions and be rational when whole market behave irrational, so there are some hidden traps that actually is not so easy to diagnose.