GTT is a leading company in the global energy sector, focusing on the design, engineering, and provision of advanced containment systems for liquefied natural gas (LNG) transportation and storage. With innovative solutions, GTT ensures the safe and efficient handling of LNG. GTT's expertise extends to various types of vessels, including LNG carriers, LNG-fueled vessels, and other marine applications.

GTT has a dominant position in its markets and there is a short-term and medium-term momentum for its business with decarbonization and geopolitical tensions.

In this article, we will unveil the activity and the different markets of the company, its outlooks, its metrics, and we will identify the bull and bear cases as well as its fair price.

To find other interesting deep dives and analysis, you can click here to find all the content available!

Company overview

The company has several activities. While new builds still represent the majority of the business, the company is trying to diversify:

Newbuilds. 91% of the revenue. Inside of this activity, we can find 3 different activities

LNG Carriers and other ships. 83% of the revenue

Onshore & GBS tanks. 1% of the revenue

LNG as fuel. 7% of the revenue

Electrolysers. 2% of the revenue. Through the brand Elogen, this activity manufactures green electrolysers and electrolysis plants

Services. 7% of the revenue

With 750 employees, 64 new patents in 2023 only, an order intake above 2 times higher than the production rate, +30% growth, 2023 has been a very good year for GTT. Let’s zoom in on the different activities.

LNG carriers and Onshore

There are different growth drivers for this activity: geopolitical tensions with Russia, decarbonization of the economy and ageing fleet of LNG Carriers.

The order book is huge. It looks like what we can see in the aerospace industry. Despite a record year in 2023, deliveries were 39 ships vs 76 in new orders and 311 in the order book.

The order books represent 1.8B€. It should allow to increase revenue in 2024 and 2025 (2023 revenue was 360M€). New orders will help to improve 2026 expected revenue.

The global LNG supply vs demand shows that there is still room for new orders. However, growth should stabilize for this activity (therefore we should not see +39% yearly growth).

The business model is attractive and supports high cash generation with milestone payments. Initial payment is 10%, then 20% for steel cutting, 20% for keel laying, 20% for ship launching and 30% for delivery.

LNG as fuel

LNG as fuel consists to adapt a ship to use LNG in its own propulsion. It enables shipowners to remain profitable in an increasingly competitive market by reducing fuel costs and emissions of ships and complies with increasingly stringent environmental regulations. It has a strong advantage vs other fuels.

Order book is also growing. 2023 revenue were 29M€, +334% vs 2022.

Services

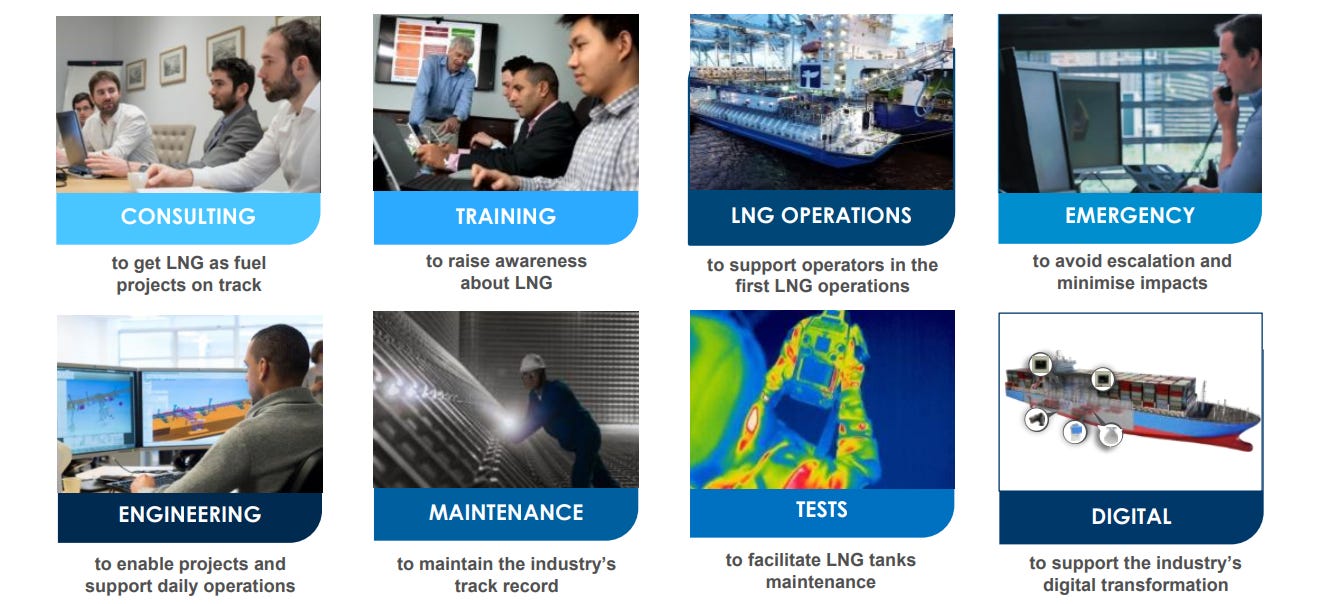

A lot of activities are present in this division from maintenance to tests, training and software.

The goal is to provide value for its customers by reducing operational costs, emissions and improving safety. GTT aims to become a reference player using its synergies with its core activities. GTT will continue to grow organically in this sector but also through acquisitions.

Strategy for future growth

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.