From Oil to Lithium: the Car R-EV-olution

Review of players, trends and perspectives

In the relentless pursuit of sustainable and eco-friendly transportation solutions, the automotive industry is undergoing a seismic shift. This shift represents more than just a change in power source; it signifies a comprehensive transformation of the whole Supply Chain, mining, engineering, manufacturing, power grid, car chargers, maintenance and spare parts.

In this article, we will take a look at the electric vehicle market, its trends and the impact of the current transformation. We will also identify market size in 2030. We will finish by screening interesting stocks using our rating system and evaluate the fair price.

The EV segments and supply chain

Several segments of EV exist:

EV (Electric Vehicle), without IC engine

HEV (Hybrid Electric Vehicle), with IC engine + an electric motor, using smaller batteries than EV. The batteries get charged by the motor

PHEV (Plug-in Hybrid Electric Vehicle), the same as a HEV but the battery can be charged from an external source

MHEV (Mild Hybrid Electric Vehicle) can never be driven solely on electric motor. The electric motors is used to assist the IC

But to really understand the Electric Vehicle sector, it is necessary to understand the whold supply chain.

The different actors in this chain are:

Miners / Refiners. They provide raw material for batteries and the rest of the car

Battery Manufacturer. The battery is the most important part of an EV accounting for 15% to 35% of the total vehicle cost

Classic Automotive Suppliers. The most interesting will of course be those producing parts that gain in importance with EV

Car Manufacturers. It is often this part that comes to the fore, as it is the brand itself. We can distringuish the pure players (Tesla for instance) and the older manufacturers turning to EV

Car Dealers. Even if e-commerce and DTC are on the rise, car dealers are still present

Spare Part Distributors and Garage. They represent the category of companies in charge of vehicle maintenance and service

Recycler. From collection, reuse and recycling itself, a lot of actors are involved

Infrastructure builders and operators. Often criticised for its inadequacy and with a very different rationale from that of fossil fuels, infrastructure is vital to the development of EVs

In the screener at the end of the article, we will rate companies from all these categories.

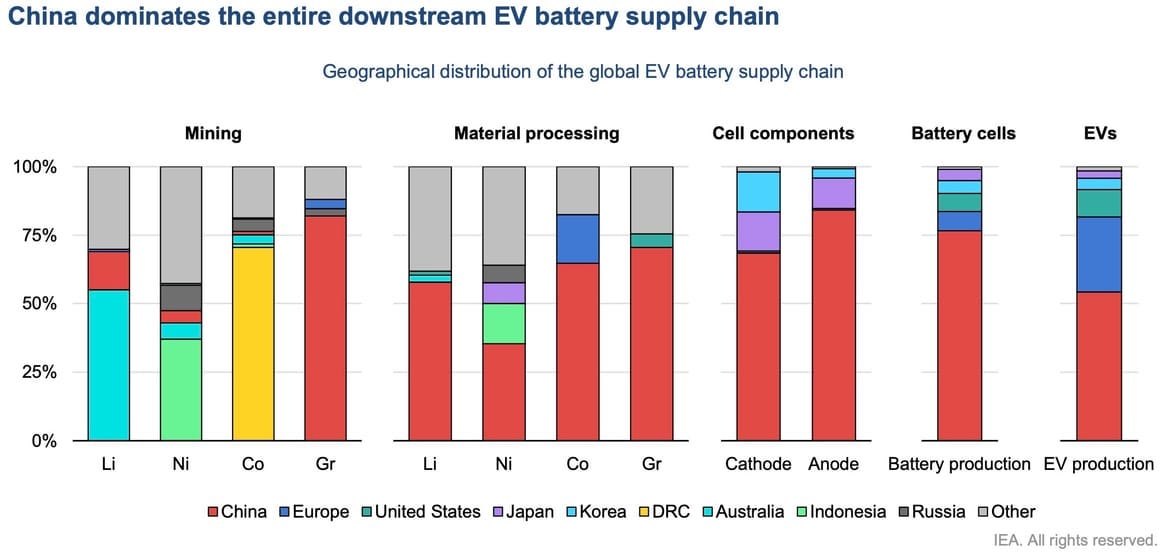

This new supply chain in the making is currently dominated by china, which has clearly identified its potential. China can be found at every point in the value chain, from mining to battery and vehicle production.

A significant raw materials requirements

Different raw materials are needed for an EV, especially for the battery and the motors. Main materials are: lithium, copper, graphite, vanadium, maganese, cobalt and nickel.

The supply for these raw materials will be a challenge as for the moment it doesn’t fit at all the estimated volumes.

New solutions will have to be found. In the case of copper, a study identified a gap in the supply vs demand of 6.6 million metric tons in 2031. They estimate that new technological solutions will have to be found.

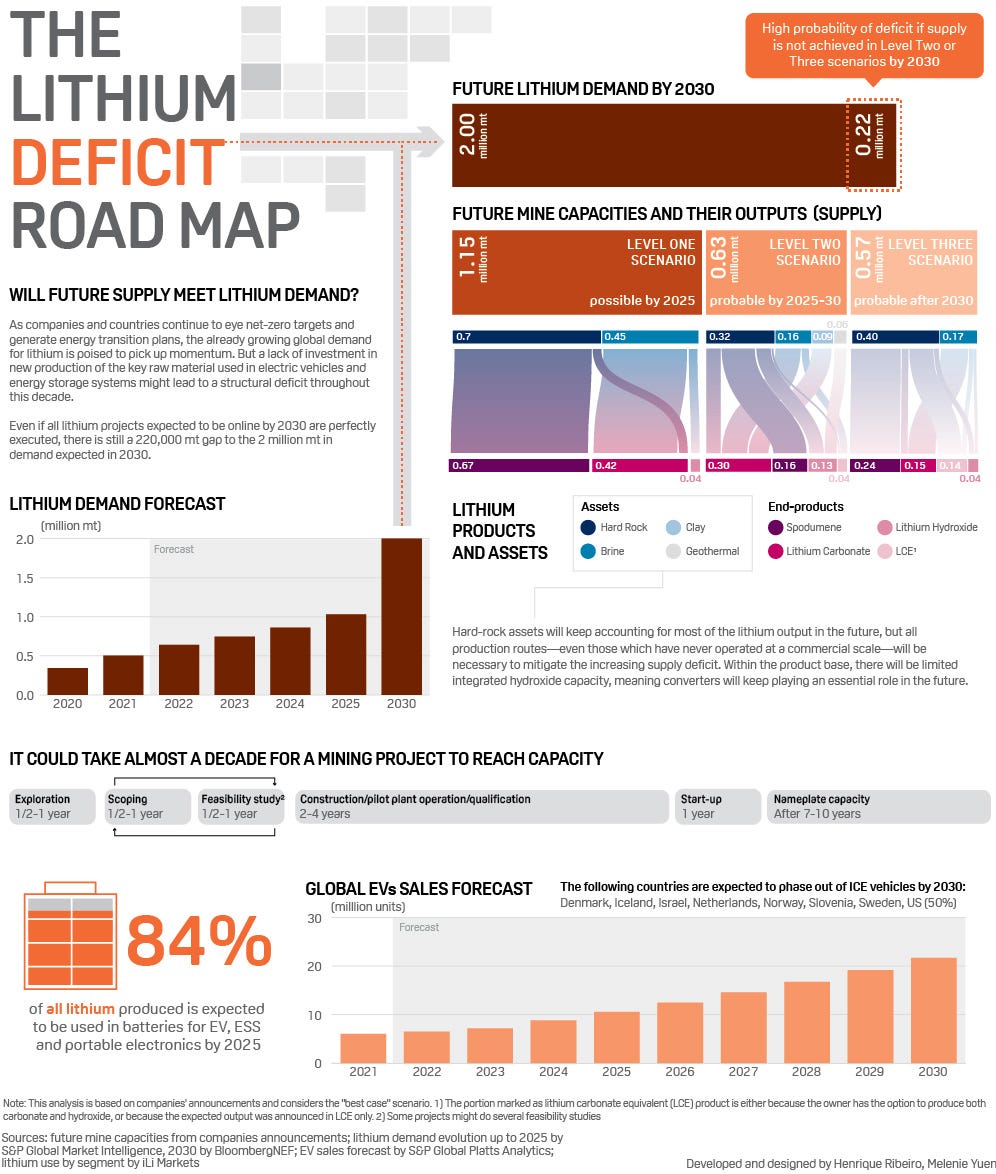

Lithium is also a major issue. 84% of the global supply will be used for EV batteries. By 2030, the global supply should have a deficit of 0.22 million metric tons.

If that weren't enough, the origin of the raw materials is also going to be a problem, since many of these resources are located in countries with which geopolitical tensions can arise.

It is easy to see why raw material sourcing is such an important issue when it comes to electric vehicles.

Price war and experience curve

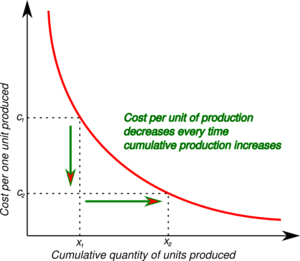

The experience curve is based on the premise that the more you produce something, the more cost effective you will become. In other words, the more “experience” you have making a product, the faster and cheaper it is to make.

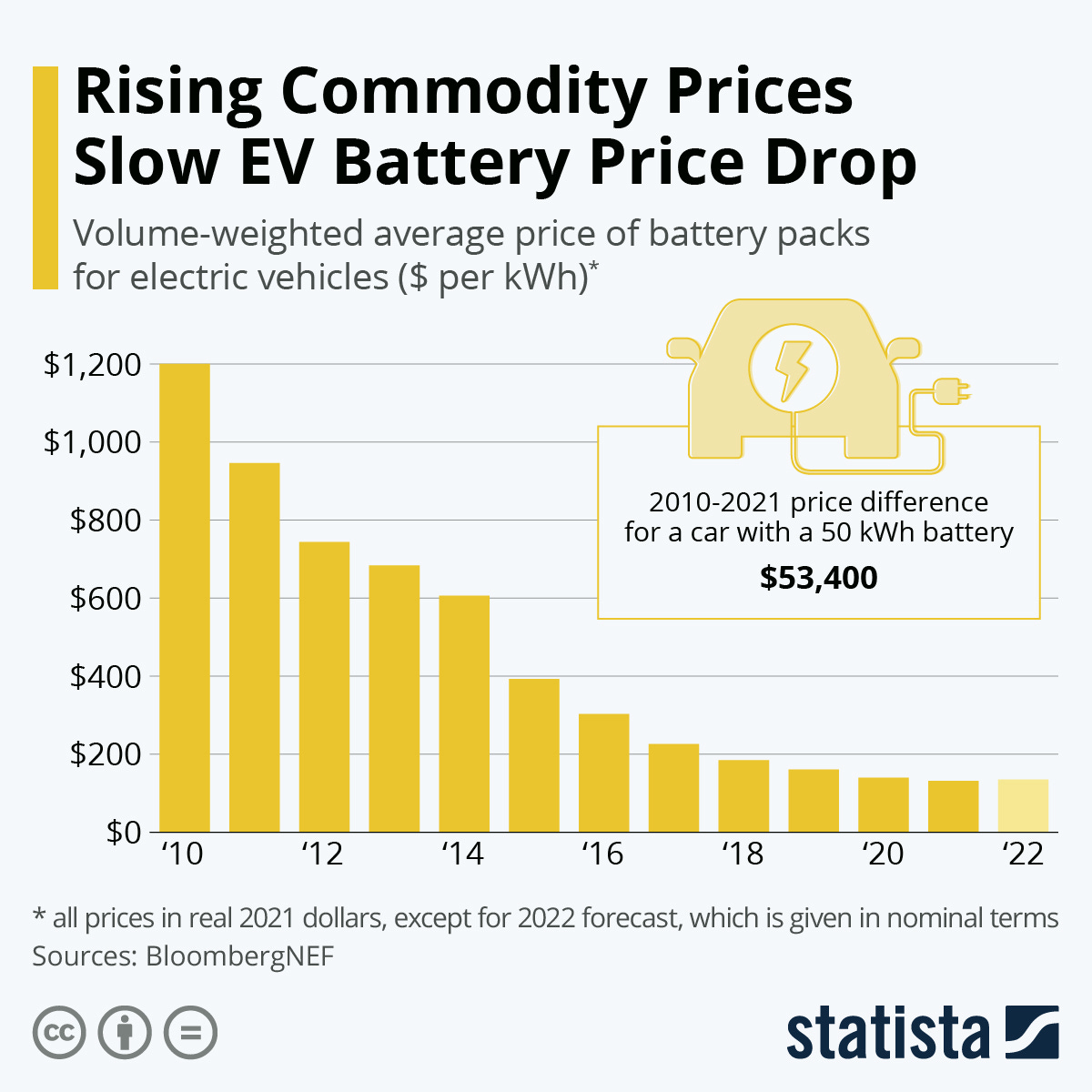

We are at the beginning of the experience curve in the EV industry. This has been well documented for the battery prices.

This price fall is accentuated by the price war due to increasing competition. It is well visible for the car prices with drastic reductions from manufacturers (Tesla for instance). If this can increase the total addressable market, it can lead to a reduction intense enough to impact the margins of manufacturers unable to adjust their volume x cost balance to stay in the race. So keep this in mind when investing in this young sector.

Market size by 2030

Before looking at the 31 stocks of the stock screener, let’s size the market by 2030 and beyond to identify the long-term growth potential.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.