Economic Moat, the Investor Holy Grail

Discover what a moat is and some examples

If you are an investor, you hear a lot about moat. But what does that mean? It is a metaphorical shield that protects businesses from the competition, ensuring their longevity and prosperity, as a real moat protects a castle.

A moat is not just a competitive advantage or seeing some success in a business, it is a strong advantage allowing the company to earn and maintain a domination on its market.

In this article, we will use the most common definition and explore 5 sources of moat:

Network effect

Intangible assets

Cost advantage

Switching costs

Efficient scale

Network effect

A network moat emerges when a company's product or service becomes more valuable as more people use it. This is easy to understand for social media platforms, as the more users they have, the more valuable they become to both users and advertisers.

Example of companies with a network effect moat: Visa, Meta, Intercontinental Exchange, American Express.

Intangible assets

An intangible asset moat refers to competitive advantages stemming from non-physical assets like intellectual property, brand recognition, proprietary technology, and organizational culture. These assets are hard to replicate, providing companies with sustainable market dominance and barriers to entry. Examples include patents, strong brands, unique know-how, and a stellar reputation, all of which bolster a company's long-term success by fostering customer loyalty, innovation, and operational efficiency.

Example of companies with intangible assets moat: Coca-Cola, LVMH, Hermes, Novo Nordisk.

Cost advantage

A cost advantage moat is when a company can produce goods or services at a lower cost than competitors, giving it a sustainable edge in the market. This advantage could come from superior technology, efficient operations, access to unique resources, or favorable supplier contracts. By keeping costs low, the company can either offer competitive prices while maintaining profitability or reinvest savings into further strengthening its position.

Example of companies with cost advantage moat: Amazon, TSMC, Walmart.

Switching costs

Switching costs create a moat when it is difficult or expensive for customers to switch from one product or service provider to another. Companies leverage this advantage by integrating their products deeply into their customers' workflows or by offering proprietary formats. This makes it cumbersome for customers to switch, fostering long-term relationships and reducing customer churn.

Example of companies with switching costs moat: SAP, Automatic Data Processing, Salesforce, Microsoft, Fastenal.

Efficient scale

Efficient scale exists when a limited size market is served by few companies. This limits the competitive pressure. Additionally, market entry often requires very high capital costs. It commonly applies to companies involved in telecommunications, utilities, transport infrastructure and energy infrastructure.

Example of companies with efficient scale: Union Pacific Corp, Canadian National Railway.

Moat and metrics

Moat can usually be seen in the company metrics.

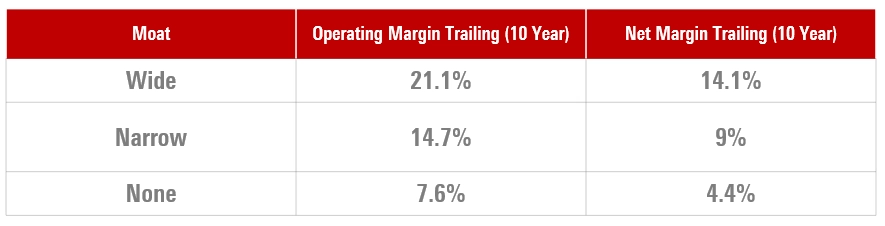

In this Morningstar analysis, we can see that wide moat stocks have a higher operating and net margins than narrow moat stocks and even more than stocks without moat. Of course, other metrics will be impacted like ROE, ROIC - in case of moat, these metrics will be high (example: above 15% to 20% ROIC) and will last for a long period.

Of course growth and market share are also good sign of moat. Gaining market share is often a sign of increasing competitive advantage.

Some examples

Here are some examples of wide moat companies if you are curious. Note that having a wide moat does not mean high returns:

Adobe

Alphabet

Altria

Amazon.com

American Tower Corporation

ASML

Autodesk

Blackstone

Cadence Design Systems

Canadian Pacific Railways

CME Group

DexCom

Fair Isaac

Hermes

Idexx Laboratories

Intuit

Intuitive Surgical

Johnson & Johnson

Lockheed Martin

L’Oreal

LVMH

Mastercard

Microsoft

Moody’s

MSCI

MVidia

RELX

S&P Global

Synopsys

Taiwan Semiconductor

Thermo Fisher

Visa

Waste Management

Zoetis

Conclusion

In conclusion, the concept of moats provides a valuable framework for understanding how businesses establish and maintain competitive advantages. By recognizing the different types of moats and their respective strengths, investors can make informed decisions about where to allocate resources and how to build sustainable businesses. Moreover, understanding the dynamics of moats underscores the importance of innovation, customer focus, and operational excellence in creating enduring value.

However, a moat is not eternal. It can erode over time due to technology - AI is the current best and most famous example. Companies must therefore continuously adapt their strategy to maintain and reinforce their moat.

Moody's has one of the biggest moats out there (along with S&P)