Eagle Materials: Concrete Profits

Cement, concrete, aggregates, a very profitable boring business

Founded in 1963, the company completed its IPO in 1994. The company operates on two primary business lines: Portland Cement and Gypsum Wallboard. These basic building products are used in construction: primarily in infrastructure, residential, repair and remodel, and to a lesser degree non-residential.

Throughout this presentation, we will dissect the financial fundamentals of Eagle Materials, shedding light on its revenue streams, profitability, and overall financial health. By examining key performance indicators and financial metrics, we aim to provide you with a comprehensive understanding of the company's strength and potential.

Once again, boring businesses turn out to be good investments!

Company overview

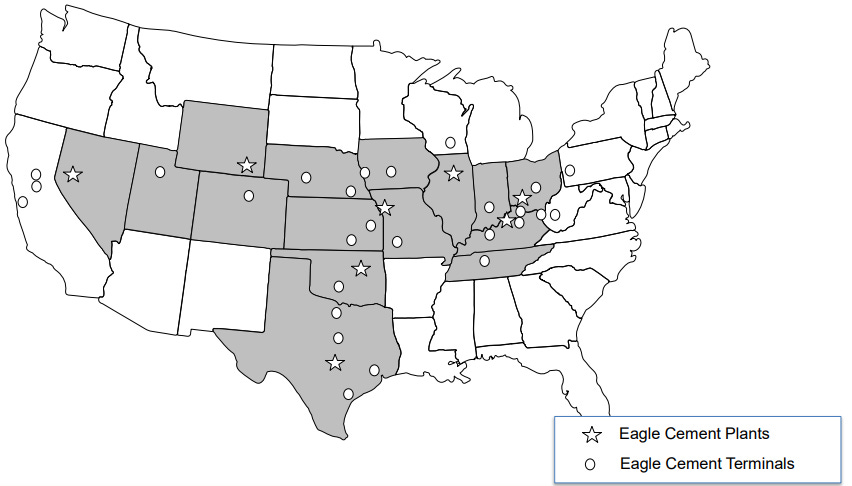

100% of its revenues come from the US using its network of 70 production facilities. Its revenues are quite diversified with no customer accounting for more than 10% of its revenues and the top 10 representing around 30% of the revenues.

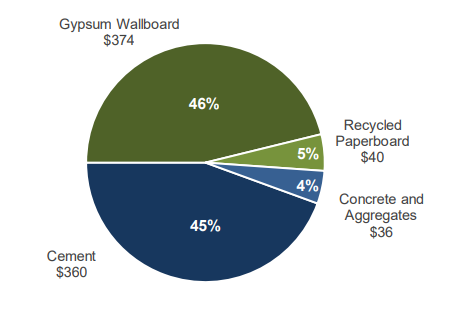

Their 2 products lines, cement and wallboard, account for equal shares of sales.

The cement is the heavy material product line of the company. The annual production capacity is around 8 million metric tons. As transportation costs are high, one of the key elements of performance is to own a good network of production facilities to each customer is close and therefore transportation cost is low.

Gypsum wallboard, the second product line, is a key component in the construction of walls and ceilings in residential and commercial buildings. Eagle is the US fifth largest wallboard producer with an annual production capacity of 4 billion square feet.

An interesting point is that Eagle owns its raw materials sources. They are therefore not dependent and have “many decades” of supply.

The revenues surged from $579M in 2011 to $2,387M in 2023. They manage to grow despite the economic cycles. They are heavily dependent on housing and construction markets.

They made a significant acquisition in 2020, helping them continue to grow and improve their margin. Their capital allocation is quite simple: 55% for the shareholder (dividends and share repurchases), 45% to invest in their business (acquisitions, expansion)

Comparison with peers

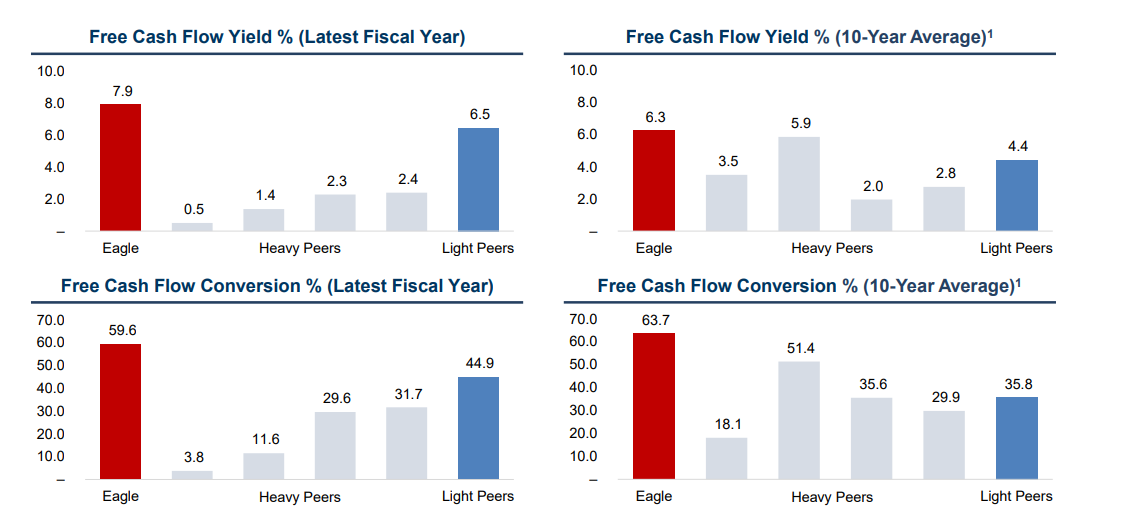

One of the most interesting things with Eagle Materials is their capacity to deliver better results that their competitors.

This performance is visible on margins, FCF, ROE and ROIC. We can see that not only are the metrics better than the competition, but they are also improving over time.

The environmental aspects

Of course, Eagle Materials' activity emits a significant amount of CO2, but it is a necessary activity nonetheless. By improving its products and processes, the company strives to reduce its carbon footprint.

They follow an ambitious strategy to aim a net zero footprint by 2050.

Market by 2030

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.