Cadence, a Pick-and-Shovel Play in the Semiconductor Industry

EDA software powering the future of technology

Semiconductors are the foundation of today’s technological revolution, powering AI, cloud computing, data centers, and digitalization. Designing these advanced chips demands sophisticated software. Previously, we compared Cadence with its major competitor, Synopsys, in a stock duel, which ended in a tie (you can find the comparison here). Now, it is time for a deeper dive into Cadence, exploring its business model, growth outlook, risks, opportunities, and determining its fair value.

Company overview

Electronic Design Automation (EDA) refers to a category of specialized software tools used by engineers to design, analyze, and verify complex electronic systems, particularly integrated circuits and semiconductor devices. Cadence is one of the leaders of this market with Synopsys or Siemens EDA.

EDA tools help automate the design process of chips and electronics, allowing designers to efficiently create, simulate, test, and optimize circuits that would otherwise be too intricate to manage manually.

EDA encompasses various stages of chip development, including design, simulation, verification, physical design, power analysis, and manufacturing.

As systems become increasingly complex, integrating hardware and software, semiconductors are now designed as part of a comprehensive system rather than just individual components. Effective semiconductor design involves not only creating efficient chips but also ensuring their seamless integration into the broader system, including managing complex radio communications and system-level integration. Modern design focuses on optimizing power, area, and cost while meeting time-to-market demands.

Cadence refers to this approach as Intelligent System Design. The company offers not just EDA software for chip design but also solutions for system creation and chip integration.

Cadence provides a suite of modules tailored to specific needs in chip and system design. This includes 3D-IC modules, computational fluid dynamics (CFD) software, system software partnerships, and automated verification platforms, among others.

Cloud offers a fully cloud-enabled platform with a high revenue recurrence rate of over 85%. This ensures both visibility and stability in the business.

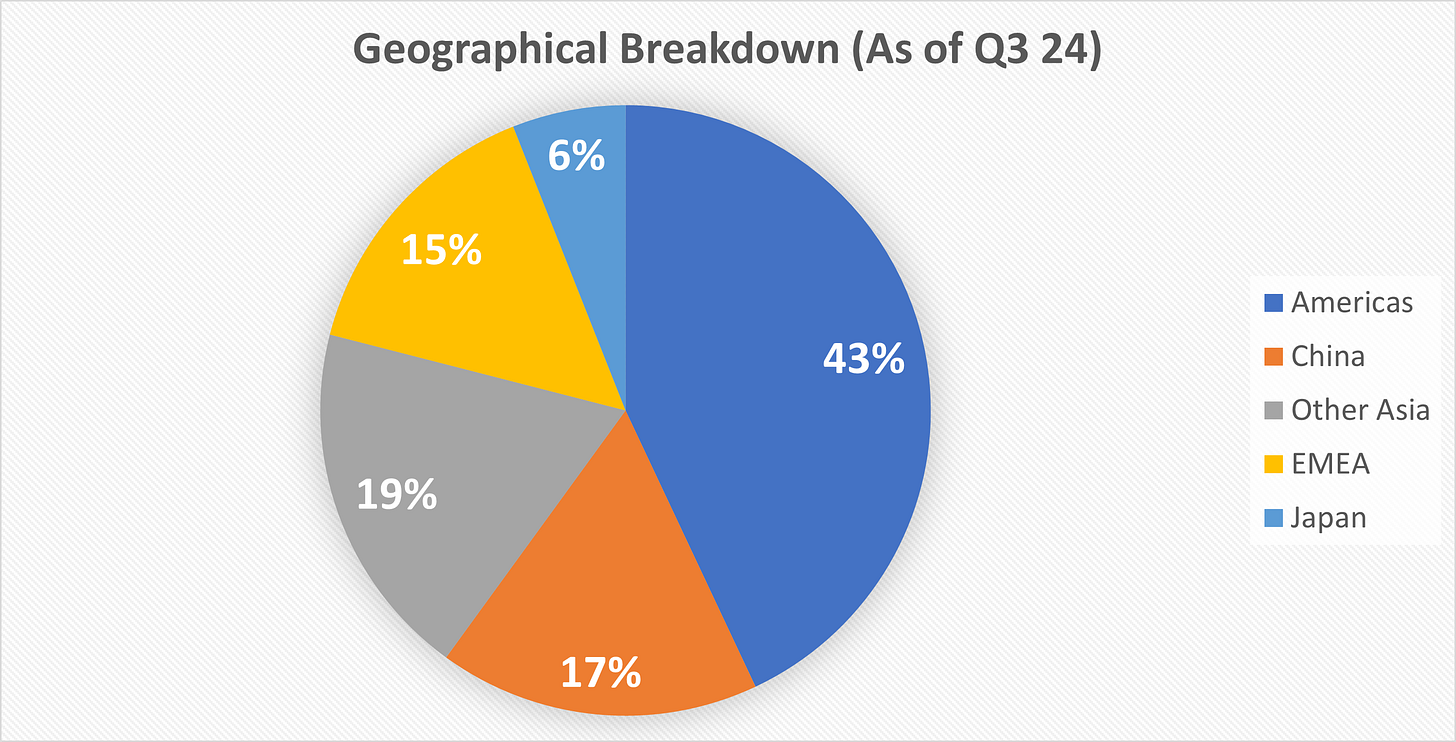

The geographical distribution of revenue is fairly diverse. However, those wary of significant exposure to China might find the 17% revenue share from that country less favorable.

A constellation of software

With a dynamic acquisition history, having completed over 10 acquisitions in the past four years, Cadence has significantly expanded its software portfolio to address a wide range of use cases. While these acquisitions complement their core offerings, they also introduce unique applications and markets.

For instance, OpenEye, acquired in 2022, is a sophisticated scientific and computational molecular design software. It is used in semiconductor design and, when combined with AI and 3D simulation, can explore millions of potential design alternatives. Additionally, it plays a crucial role in drug discovery, being utilized by 19 of the top 20 pharmaceutical companies.

Cadence’s modeling and design capabilities extend beyond semiconductors. They are applied to analyze vortex formation and interactions, such as in Formula 1 racing.

They also can be used to design data centers, including thermal analysis for integrated circuits, cooling solutions for blades and racks, and HVAC systems for rooms and buildings.

AI delivering significant value to customers

JedAI, developed by Cadence, is an advanced AI-driven platform designed to enhance EDA processes. It integrates machine learning techniques to improve various aspects of semiconductor design and verification. JedAI leverages AI to optimize design workflows, accelerate verification processes, and enhance the accuracy and efficiency of chip design.

JedAI aims to transform the EDA landscape by integrating AI into design and verification tools, ultimately driving faster and more efficient semiconductor development.

This significantly benefits customers by enabling them to complete tasks more quickly, achieve superior results, and accomplish previously unattainable goals. Cadence can effectively monetize this value through its enhanced offerings.

Growth drivers and market outlook

Cadence operates in a semiconductor industry with several strong tailwinds:

Industrial automation and IoT

Life sciences digitalization

5G and communications

New vehicles, including autonomous vehicles

Hyperscale computing

Data science, machine learning, and AI

The company is poised for growth driven by two main factors: the expansion of the EDA market and new opportunities in areas such as digital twins, molecular simulation, and computational fluid dynamics.

Before presenting the metrics, conducting a SWOT analysis, and determining the fair price, we should first evaluate the revenue and EPS growth potential for the upcoming years.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.