Beyond Beauty: Unveiling the Allure of the Cosmetics Market

Glamour, growth and gains, what is behind this success

In the intersection of glamour and economic prowess lies a captivating arena: the cosmetics market. Far beyond the appeal of impeccable packaging and exquisite formulations, this market is a reflection of economic resilience, growth and the ever-changing dynamics of consumer behavior. As the global economy undergoes shifts and challenges, the cosmetics sector not only holds its ground but manages to grow.

The aim of this article is to present the cosmetics market, its segments and its dynamics. We will make a projection to 2030. Once we have a better understanding of the market, we will discover the companies that make it up and use our rating system to identify the most promising ones. This will include a fair price estimation process to see which stocks are undervalued, fairly valued or overvalued.

Quick overview

The cosmetics market is a dynamic sector that has seen a huge growth over the last years. Customers are mostly women (more than 60%) who are searching quality products, social recognition and an exclusive experience. This market lies in the customer staples sector, even though some parties may belong to the discretionary consumer sector, particularly in the high-end segment.

The current market size is around $400 billion. Its growth is driven by economic conditions, technological developments and consumer behavior evolutions, seeking for qualitative and sustainable products.

The market, while featuring hundreds of brands, is in fact fairly concentrated. 7 players alone own 182 brands.

It is interesting to not that some of the best-known companies, such as Chanel and Clarins, are not listed on the stock exchange. Unfortunately, fellow investors, you won’t be able to own any of these companies.

Market segmentation

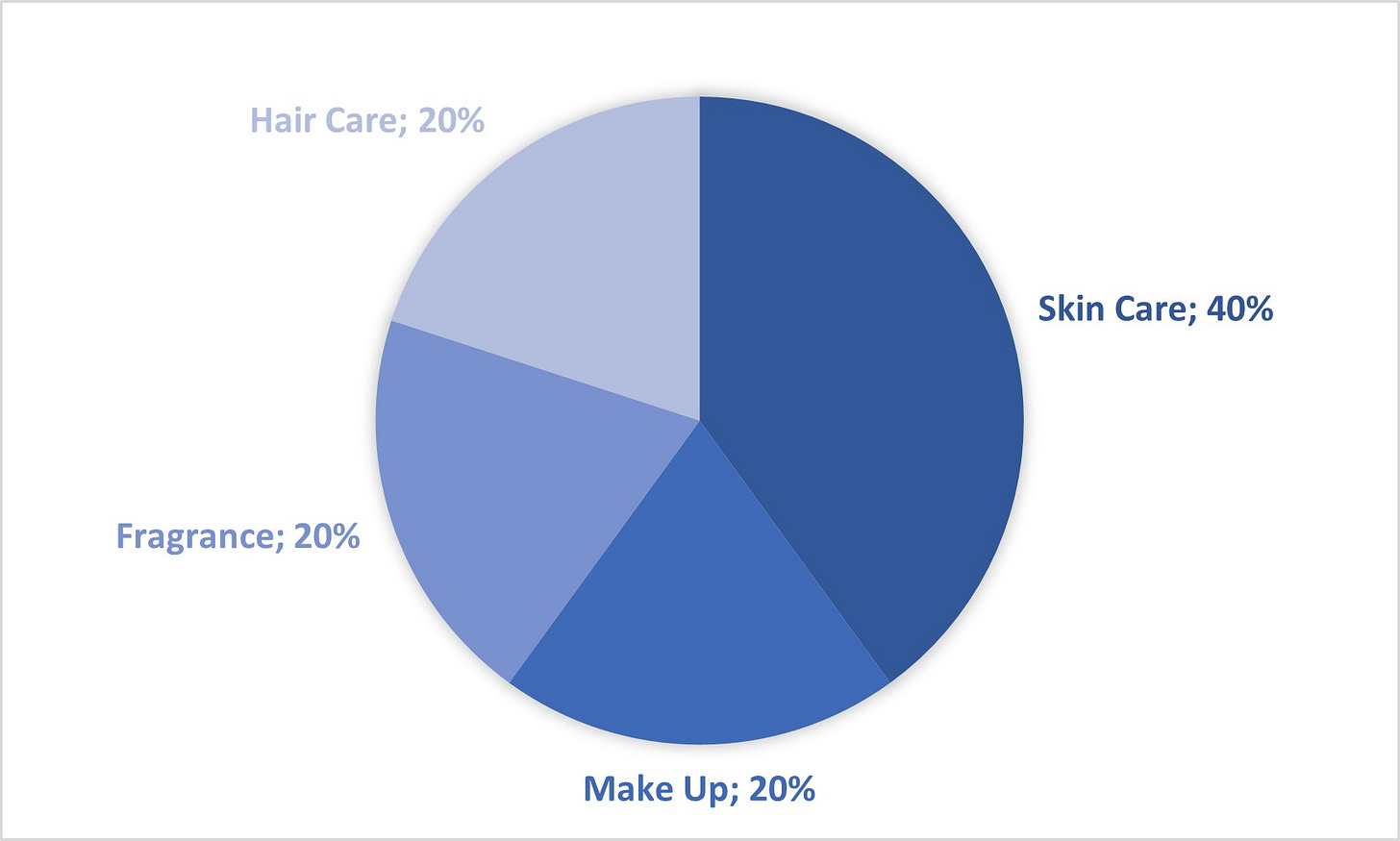

There are 4 main categories of products in this market: Fragrance, Makeup, Hair Care and Skin Care. The market share for each category is approximately 40% for Skin Care and 20% for each other category.

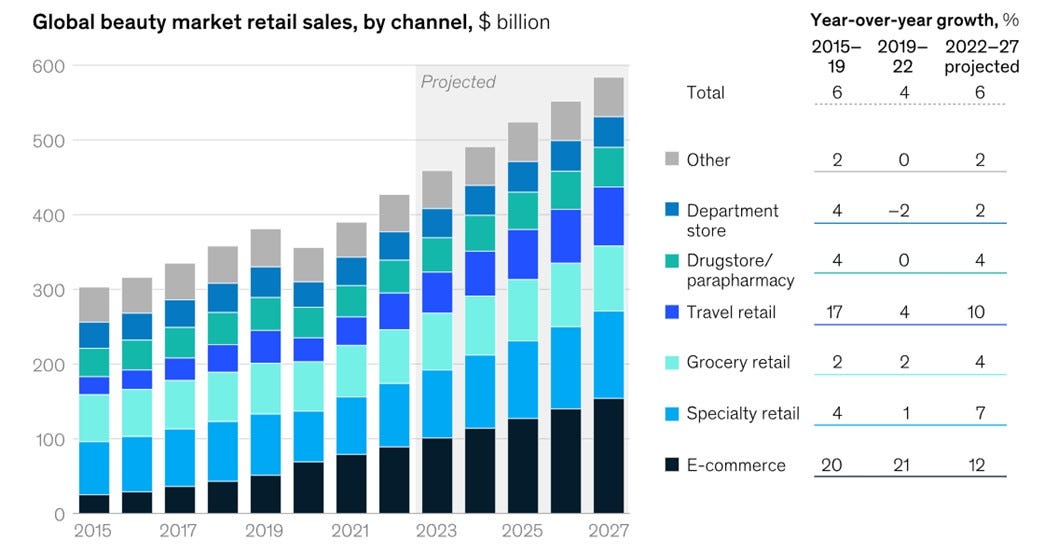

In terms of distribution Channel, the e-commerce is growing rapidly with more than 20% of the market shares. Retail (both specialty retail and grocery retail) remains the highest market share. Travel retail comes next, but is more important for the luxury cosmetics. For the other distribution channels (incl. pharmacy, drugstores, etc), they represent small market shares.

Each brand will have its specific distribution channels. Some brands for instance only sell using their own boutiques + e-commerce. Others could use only a pharmacy channel. The brand image will be one of the main factors to choose its distribution channel.

We can define several types of companies along the value chain:

Retail companies, like Ulta Beauty or Sephora (a LVMH brand) are selling the beauty products

Brand companies, like L’Oreal or Procter&Gamble, usually design, develop their products and their image, produce and distribute through their network. They can subcontract a huge part of this value chain

Subcontractor companies can be just manufacturer or can also go up to the development, the design and the marketing of the products. Here we find some companies like Interparfums

Suppliers are upstream in this value chain. They supply raw materials or components to the brands or subcontractors. It can be packaging, aromas, etc. Here we find companies like Robertet or Symrise.

Market size by 2030

The cosmetics market size is expected to reach around $586 billion by 2030. Compared to the $398 billion in 2023, that is a 5.7% CAGR. This is on line or slightly higher than the other consumer segments such as apparel, footwear, eyewear, pet care, and food and beverages.

Among the 4 categories, the growth should be almost the same. However fragrance could grow a little bit faster than the others, but it is not significant.

Market trends

Several market trends coexist inside the cosmetics market:

The e-commerce continues to rise and to gain market share vs the other distribution channels.

Therefore, the digital experience and innovations are extremely important to gain market share in this environment, both for brands and retail companies

The formulations tend to use more qualitative and environmental-friendly ingredients.

Personalization is increasing for the experiences and the products.

Supply Chains are more and more complex as the regulation is developing. This creates challenges on the execution and the margins. These regulations serve both to protect the consumer and to create protectionist barriers.

Social media platforms, beauty influencers, and online tutorials are the new ways to promote a product. The time of the muses is slowly disappearing.

The rise of independent brands is reshaping the competitive landscape. The big brands must adapt, or risk seeing their market share eroded.

The main growth drivers of the market are:

An emerging middle-class in developing countries.

Ethnic products for different origins and skin carnation are growing quickly.

The men’s cosmetics market, growing quickly compared to the rest of the market.

Aging population will increase the demand for cosmetics.

Stock screener

Now it is time to find out which stocks are the most interesting, how they are rated and whether they are over- or undervalued.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.