ASML’s Earnings Review: A Turning Point or Business as Usual?

Is the market sell-off justified?

ASML has just released its Q1 2025 earnings. While the headline numbers looked solid at first glance, the market reacted sharply: shares plunged 6% within the first few hours of trading.

But is this reaction justified? Are the results truly strong, or is there more beneath the surface? And what does the outlook signal for the coming years? Let’s break it down.

The report at a glance

Metrics analysis

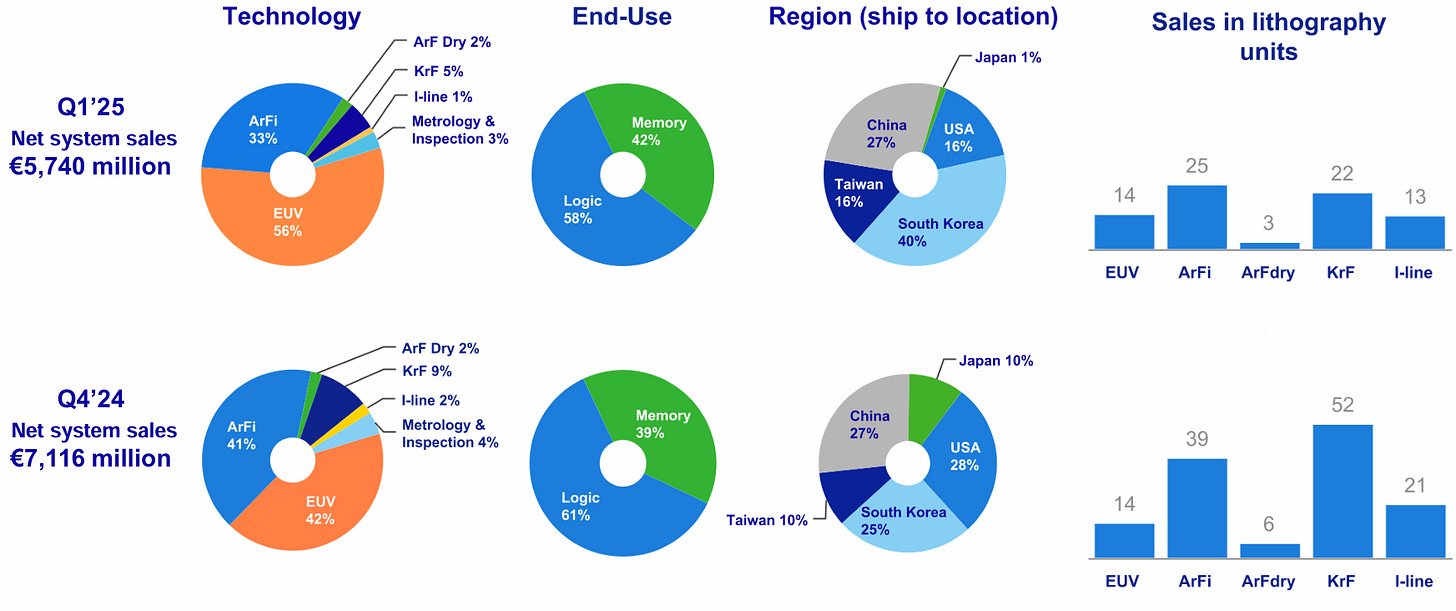

EUV systems (ASML’s most advanced and high-margin products) are becoming an increasingly significant part of the product mix. Meanwhile, Installed Base Management (IBM), which represents recurring revenue from services like maintenance, spare parts, advisory, and retrofits, continues to grow rapidly.

This trend is a key point I emphasized in my comparative analysis of ASML, KLA Corporation, Lam Research, and Applied Materials. The accelerating growth of IBM is a strategic strength for ASML (and its competitors), as it introduces a more stable, less cyclical revenue stream, creating a buffer against industry volatility.

Note: the table compares Q1 2025 with Q4 2024, whereas my analysis compares Q1 2025 with Q1 2024 to reflect YoY performance.

The main metric: net bookings

For several years now, the market has largely fixated on a single key metric when it comes to ASML: net bookings. This figure encompasses all system sales orders, including inflation-related adjustments backed by written authorizations. Net bookings serve as a strong leading indicator of future revenue, providing valuable insight into ASML’s demand pipeline and overall business momentum.

Net bookings came in at 3.9B€, falling short of the 4.9B€ consensus estimate.

This shortfall can likely be attributed to current market uncertainties and rising geopolitical tensions. Additionally, the looming risk of a global recession could prompt ASML’s customers to delay capital investments.

That said, a broader trade war (while disruptive) might also open up new strategic opportunities. “It has created a shift in the market dynamics that benefits some customers more than others, contributing to both upside potential and downside risks as reflected in our 2025 revenue range.”, said management. ASML’s management remains cautious in this environment, noting that revenues in 2025 and 2026 could be under pressure.

Outlook

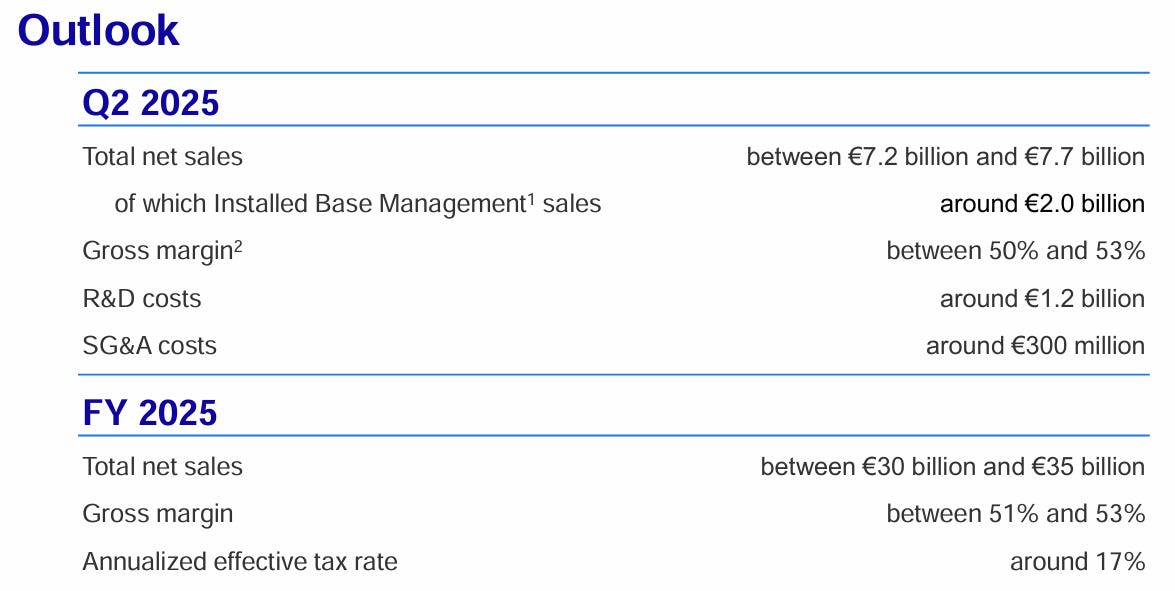

“We expect second-quarter total net sales between 7.2B€ and 7.7B€, with a gross margin between 50% and 53%. As we previously communicated, we expect total net sales for the year between 30B€ and 35B€, with a gross margin between 51% and 53%, subject to the uncertainties mentioned earlier"

"Our conversations so far with customers support our expectation that 2025 and 2026 will be growth years. However, the recent tariff announcements have increased uncertainty in the macro environment and the situation will remain dynamic for a while”, said ASML President and Chief Executive Officer Christophe Fouquet.

The 2030 outlook has been maintained (sales between 44B€ and 60B€ with a gross margin between 56% and 60%).

Conclusion

At first glance, the numbers look solid, and despite the management's cautious tone, the long-term investment thesis remains intact for those bullish on ASML.

Trade tensions and export restrictions may introduce short-term volatility, but it is hard to imagine a future where the global tech ecosystem doesn’t rely on ASML’s machines (at least for now).

The dip in net bookings is a concern, especially surprising given management previously stated they would no longer disclose this metric. That said, bookings are inherently volatile and should be viewed in context (or on a yearly basis). The market’s reaction was likely exacerbated by the US administration’s announcement restricting exports of certain Nvidia chips to China. Once again, separating short-term noise from long-term fundamentals remains a key challenge.

What is your read on ASML’s earnings report?

Here is the link to ASML’s investor relations page, where you can access all reports

Nicely done. Appreciate the insights.

Thank you