Alphabet, Overlooked for Too Long

Risks and opportunities for the technology giant

The Q1 2024 results have revealed an interesting reality for investors: the company is far from slowly dying. In fact, EPS increased by 62% compared to the prior year. Despite a negative narrative since 2022 and some stagnation in FCF during 2022 and 2023, the metrics have consistently improved over this period.

So, what lies ahead? What are the risks and opportunities for this giant? To answer these questions, we will analyze the company's business, metrics, and outlook.

Company overview

Let’s begin by examining how Alphabet Inc. reports its revenues:

Google Services

Google Services represent the vast majority of Alphabet’s revenues. However, it is growing at a slower pace compared to other segments, decreasing from 88.8% of total revenue in Q1 2023 to 87.6% a year later. It was above 90% a few years ago. Within Google Services, there are two main activities:

1. Google Advertising

Google Advertising is the main revenue stream, constituting 88% of Google Services and roughly three-quarters of the total revenue. This category is further divided into several segments:

Google Search and Other: This includes Google Search, the flagship product, which accounts for three-quarters of Google Advertising revenue and 57% of total revenue.

YouTube Ads: Revenue generated from advertisements on YouTube.

Google Network: Income from ads placed on Google Network Members' properties.

2. Google Subscriptions, Platforms, and Devices

This segment includes revenue from subscriptions (e.g., YouTube Premium), platforms (e.g., Google Play), and devices (e.g., Pixel phones and Nest products).

Google Cloud

Google Cloud represents a significant opportunity for margin increase, having reached breakeven for almost two years. It is also experiencing rapid growth.

Other Bets

Despite currently losing money, the Other Bets segment is growing extremely fast, with a year-over-year increase of over 70% in Q1 2024.

By analyzing these segments, we can see that Alphabet’s core strength lies in its advertising business, but it is also making significant strides in cloud services and other innovative areas.

Zoom on Other Bets

Alphabet encompasses various subsidiaries and experimental businesses that operate independently from Google. These entities are part of the company's "Other Bets" category, and they focus on diverse, innovative fields:

Waymo: Autonomous driving technology.

Intrinsic: Industrial robotic software.

Chorus: Supply chain sensor development.

Tapestry: Electric grid technology.

Isomorphic Labs: Drug development.

Tidal: Ocean protection.

Mineral: Sustainable agriculture with data analysis tools.

Bellwether: Planetary data intelligence.

280 Earth: Direct air carbon capture.

Taara: Wireless optical communications.

The Everyday Robot Project: Learning robots.

H2E: Atmospheric water harvesting.

Wing: Delivery drones.

Loon: Internet balloons (now defunct).

Verily: Life sciences focusing on machine learning, sensors, and devices.

Glass Enterprise Edition: Smart glasses.

Makani: Energy kites.

Malta: Salt-based energy storage.

Project Foghorn: Seawater fuel.

Dandelion: Geothermal energy.

Brain: AI and machine learning.

Chronicle: Cybersecurity.

Fiber: High-speed internet service.

DeepMind: Artificial intelligence and machine learning.

Alphabet established the X-Moonshot Factory (commonly known as X) to nurture these initiatives, particularly in their early stages. While many of these projects may not achieve commercial success, there have been notable successes such as Nest, which transitioned from Other Bets to Google’s Subscriptions, Platforms, and Devices in 2019.

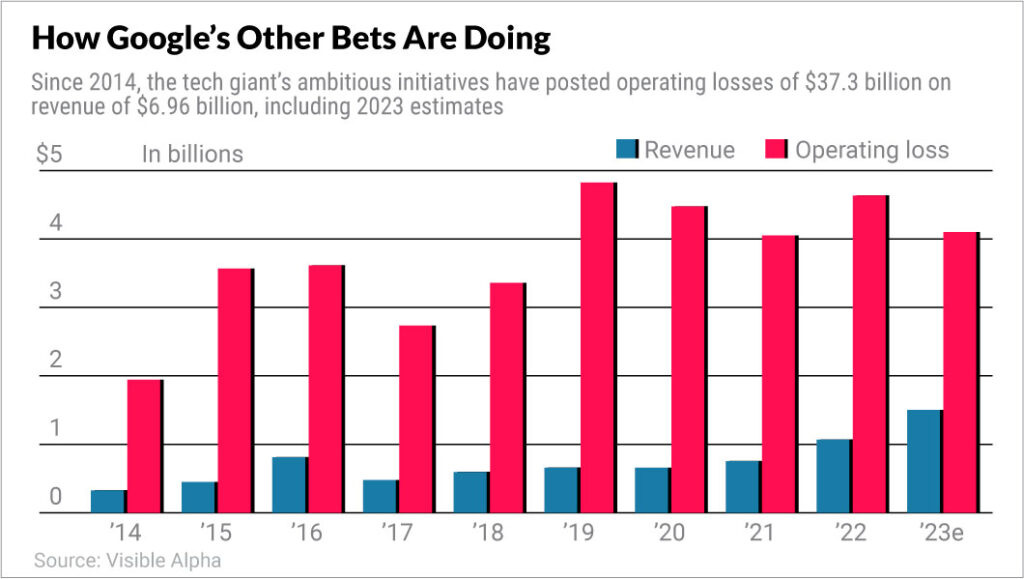

Between 2014 and 2023, Other Bets generated cumulative revenues of $7.3 billion but incurred operating losses of $37.3 billion. However, the pace is accelerating. In Q1 2024, Other Bets reported operating losses of $1.02 billion, a 16.7% improvement year-over-year, while revenues increased by 71% to $495 million.

Strategy

Alphabet employs a multifaceted strategy aimed at maintaining its dominance in the tech industry while developing new growth areas, to diversify its revenue streams. This is particularly evident in the decline of ad revenue compared to other revenue streams, even though there is still a long way to go.

Innovation and research and development (R&D) are central to Alphabet’s strategy, as we saw with the Other Bets segment. Alphabet invests heavily in artificial intelligence (AI) and machine learning, integrating advanced AI across its products and services to enhance their functionality and efficiency. Cloud and AI are the main growth driver for the company.

The CAPEX level (above 15% of the revenue) recently increased. These expenditures are directed towards data centers, office facilities, and infrastructure that support Google Cloud and other core services. Investment in physical infrastructure is essential for maintaining the performance, reliability, and scalability and will contribute to moat improvment.

Strategic acquisitions and investments play a crucial role in Alphabet’s growth. The company makes targeted acquisitions to enhance its technology portfolio, such as acquiring Fitbit for health and fitness technology and Looker for data analytics. Alphabet’s investment arms, GV (formerly Google Ventures) and CapitalG, invest in startups and growth-stage companies to foster innovation and secure strategic advantages.

Capital allocation

One of the most noteworthy elements of Alphabet is its substantial cash reserve, which exceeds $100 billion. This cash reserve has remained the same for years. This substancial amount of cash could be used for strategic acquisitions, as the one of Youtube almost 20 years ago.

More recently, the potential $23 billion offer for Wiz, a company specializing in cloud security, clearly indicates that the company aims to continue diversifying its revenue streams, with cloud technology being central to this strategy.

Alphabet also holds stakes in several companies, even if the percentages are small:

15.67% of Gitlab for $441M

1.23% of Hubspot for $370M (they will maybe sell this participation as the deal to acquire Hubspot has been cancelled)

0.95% of JD.com for $350M - they recently annouced that they will sell this stake

0.37% of Crowdstrike for $327M

0.19% of ARM for $320M

0.79% of ZScaler for $228M

3.21% of Revolution Medicines for $205M

0.45% of Dexcom for $203M

The excess cash is primarily allocated for share buybacks. On average, Alphabet repurchases around 2% of its shares annually, in addition to offsetting the generous stock-based compensation (SBC) provided to its employees.

In 2023, Alphabet's SBC amounted to approximately $22.5 billion, which represented about 32% of its $69.5 billion in free cash flow (FCF).

Recently, Alphabet initiated a new dividend with an approximate yield of 0.4%, representing a payout ratio of under 10%. This move marks a new phase in the company's development, signaling a commitment to returning value to shareholders while continuing to invest in growth and innovation.

The AI risks and opportunities

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.