(119) Small Caps Stock Screener - Jan. 24

A huge screener to analyze 119 interesting small caps

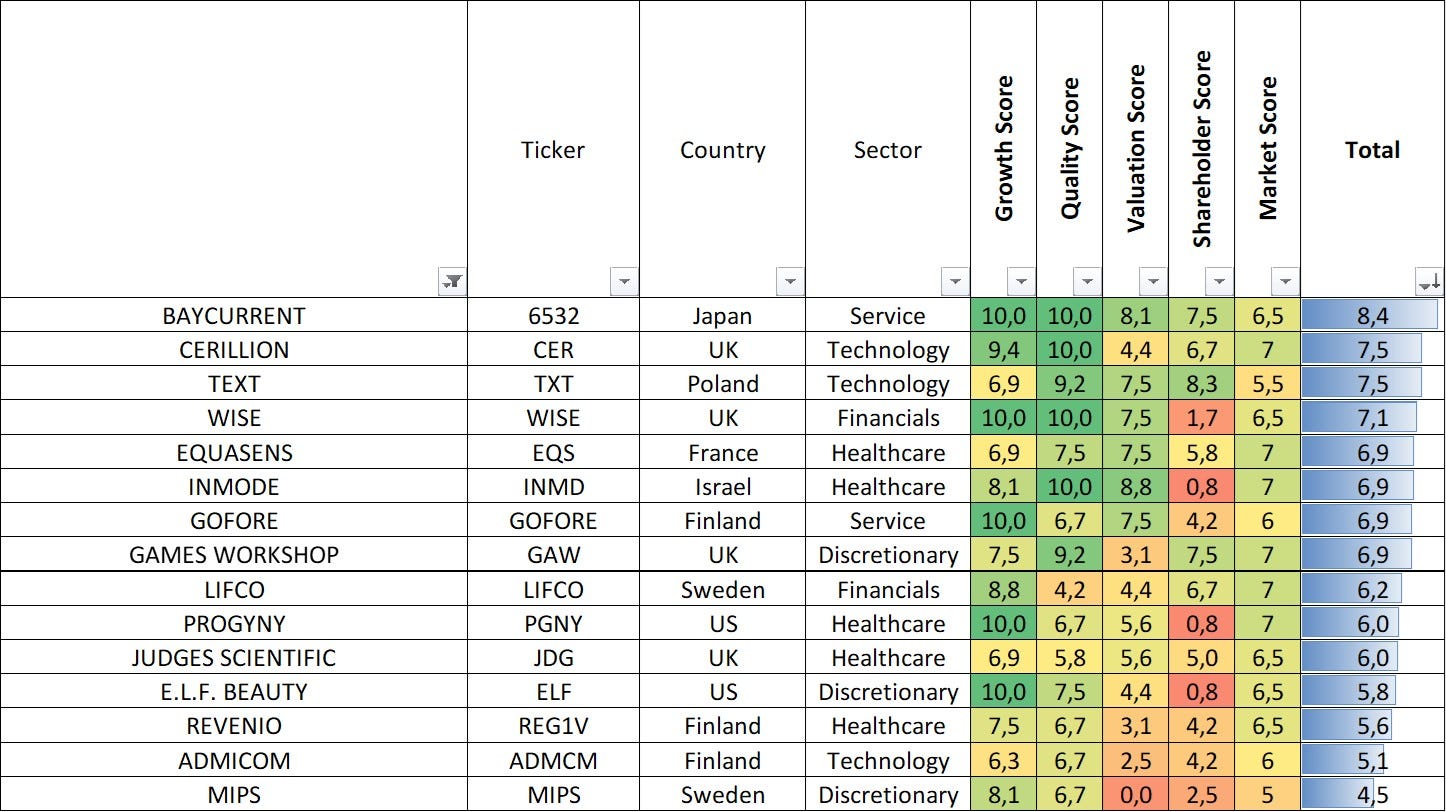

I use this exact screener for my own investments. It is not a simple yes/no test: the goal is rather to identify which stocks will make it onto my shortlist. The ratings reflect my investment style to quickly identify what I am looking for in a stock. I am sharing it so you can compare with your investing process and highlight your decisions.

The different scores

The screener uses 5 different categories. Each category has different metrics, mainly quantitative. Each metric gives a score depending on thresholds I defined, once again to fit my investment style.

Growth. The growth category uses 4 metrics:

Past and future revenue growth

Past and future EPS growth

Quality. The quality category uses 3 metrics: net profit margin, ROE and cash/debt ratio vs the EBITDA.

Valuation. For valuation, I use 3 metrics: PE, FCF yield and PEG.

Shareholder return. This category shows if the company is shareholder oriented. I look at 3 metrics: dividend yield, dividend growth and buybacks/dilution in outstanding shares.

Market. This is the only qualitative metrics. It represents the value of being present in the market and the company’s strength in it. It is a personal appreciation.

The screener

I selected 119 small caps and then used my rating system to identify potential interesting stocks. Discover the results here.

Please note that this is a purely mathematical calculation and that a thorough analysis is necessary before buying a share. Therefore, the purpose of this screener is to identify an investment universe (depending on your investment strategy)

Here are 15 stocks for the free subscribers. The whole screener is behind the paywall.

Keep reading with a 7-day free trial

Subscribe to Quality Stocks to keep reading this post and get 7 days of free access to the full post archives.